Top 10 Ways to Grow Your RRSP

Saving for retirement might seem straightforward on paper, but truthfully, there’s an art to building your “RRSP empire.” In fact, many Canadians still struggle to understand registered retirement savings plans and how…

Read more

5 Quick Tips for RRSP Season

For most people, a Registered Retirement Savings Plan (RRSP) is that thing you’re putting money into to save for retirement. And you’re right, it is. But beyond that, many people’s…

RRSP vs TFSA. Which is better for you?

The great debate: TFSA vs RRSP With the RRSP contribution deadline just around the corner, it’s important to know about all your savings options. Today we break down which savings…

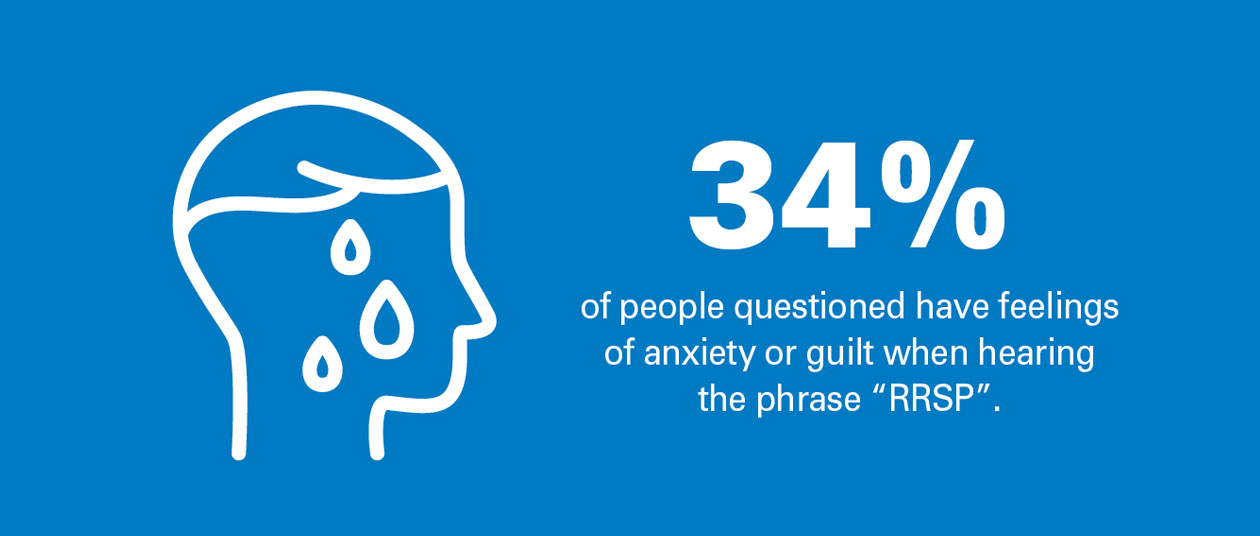

Feeling stressed about RRSPs? You’re not alone.

As March 2 approaches (that’s the RRSP contribution deadline for the 2025 tax year), many British Columbians experience feelings of guilt and anxiety just thinking about retirement savings. We recently…

Advanced TFSA strategies for serious investors

The Tax-Free Savings Account (TFSA) is one of the most powerful tools in any Canadian investors’ financial toolbox. It allows you to grow, save, and withdraw money tax-free, making it…

Pay Yourself First: the benefits of automatic savings.

Regular savings are an important part of financial health, whether you’re building up an emergency fund or saving for a comfortable retirement. Unfortunately, it’s not always easy to put aside…

Explore our topics

Managing Your Money

Making complicated money matters easier.

Explore topicMaking complicated money matters easier.

Planned giving: a powerful way to give back and build your legacy

When we think about charitable giving, we often picture volunteering our time or sending cash donations to groups that help in times of need. Planned giving on the other hand,…

Five end-of-year financial best practices to set you up for 2026

2026 is already in sight, and as the year winds down and we get ready to enjoy the holidays, now’s a great time to ensure your finances are in shape…

What to do with a tax refund

Written by Isaac Veeneman, CFP®, BBA, Associate Financial Planner Receiving a tax refund can feel like free money, and it’s natural to want to enjoy it. Whether you’re thinking about…

Grow Your Money

Tips to help you make the most of your investments.

Explore topicTips to help you make the most of your investments.

The safe, boring way to be brilliant with your savings

How a HISA and GIC can strengthen your savings Where you keep your savings matters, in terms of how they grow and how easy they are to access. You want…

5 must-do’s after opening a High-Interest Savings Account (HISA)

Five simple habits to help your savings grow steadily A High-Interest Savings Account (HISA) is a simple, reliable way to grow your money over time. Whether you’ve just opened one…

Anxiety amid market volatility

As many of you know, the past week has seen the market experience sharp declines that have undoubtedly stirred feelings of uncertainty and anxiety. I want to take a moment…

Working at Coast

All about working at Coast Capital Savings.

Explore topicAll about working at Coast Capital Savings.

Chris Van, Financial Planner

To get to know Chris a bit better, we recently sat down and asked him a few questions. If you are interested in booking an appointment with Chris, please email…

Diltaj Kaur, Financial Planner CFP|CIM

To get to know Diltaj a bit better, we recently sat down and asked her a few questions. If you are interested in booking an appointment with Diltaj, please email…

Employee Spotlight: Jaya Virk

To get to know Jaya a bit better, we recently sat down and asked her a few questions. If you are interested in booking an appointment with Jaya, please email…

Small Business Centre

Tips and articles to help your small business thrive.

Explore topicTips and articles to help your small business thrive.

Digital Marketing Plan

The following article, including editable template, is available for download as a PDF here: Coast Capital Digital Marketing One Page Plan By understanding how your clients make purchasing decisions and why they…

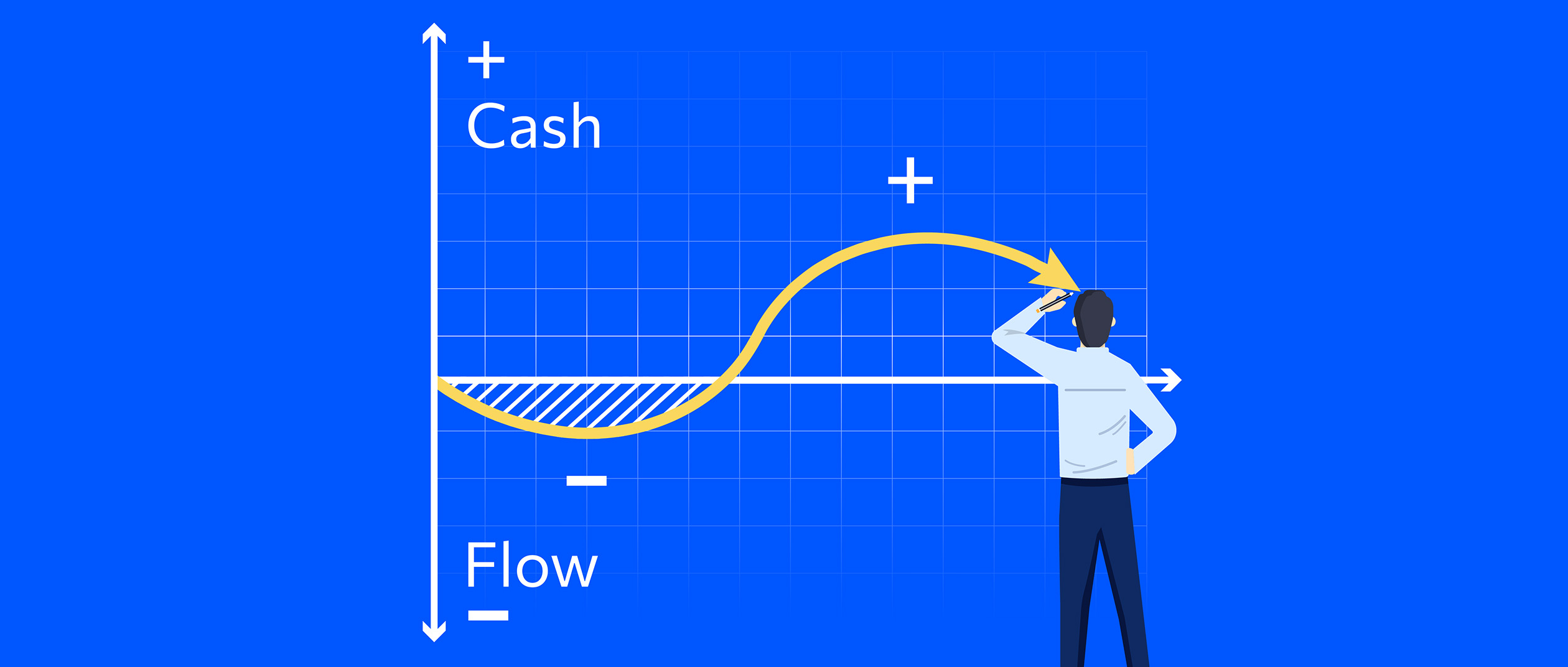

How to forecast cashflow

The following infographic is available to download as PDF here: Coast Capital How To Forecast Cashflow An accurate cashflow forecast is like a map of your business journey. Without it, you…

Business Checklist: Diversifying your business

Diversifying your goods, services, or income streams can provide a safety net against market volatility, seasonal fluctuations, or declines in a particular area of business. It also opens new avenues…

The Art of the Side Hustle

Tips for how to become your own boss.

Explore topicTips for how to become your own boss.

The gig worker savings plan.

The gig economy is no longer just for side hustlers. It’s become an important aspect of work life for many people. Gig workers—defined as those who participate in short-term contracts…

Bookkeeping secrets for the gig economy

Bookkeeping secrets for the gig economy Managing your own books can send shivers down the spines of even the bravest of freelancers. Whether you’re spearheading your own startup, consulting on…

How to promote your side hustle like a full-fledged business

Side hustles are here to stay. According to Statistics Canada, the number of Canadian gig workers jumped by 70 percent between 2005 and 2016—that’s an increase of 1 million to 1.7 million…

Career Corner

Explore articles for those starting or transitioning their careers.

Explore topicExplore articles for those starting or transitioning their careers.

Mentorship 101: How to find and build a strong professional mentorship

Mentorship is one of the most powerful tools for career development. Whether you’re just starting out, changing careers, or stepping into a leadership role, mentorship offers clarity, confidence, and direction.…

9 Essential soft skills that employers look for

In today’s competitive job market, a resume filled with impressive qualifications and technical expertise is no longer the only ticket to landing your dream job. Employers are increasingly prioritizing soft…

5 tips to build your personal brand

In today’s job market, your personal brand is your career currency. Whether you are exploring new career opportunities or looking to grow your income, there’s one powerful (and often overlooked)…

Joining Finances with a Partner

Find out if, when and how you should combine finances with your partner.

Explore topicFind out if, when and how you should combine finances with your partner.

Advice from Kaya Marriott | What to discuss with your partner before joining finances.

Kaya Marriott is a Canadian content creator, who got her start as a Natural Hair Blogger back in 2016 when she launched comfygirlwithcurls.com. As time went on, her brand has…

WEBINAR | How to combine finances with your partner.

So, you’re taking your relationship to the next level. Congratulations! This is an exciting time for you, full of hope for the future and opportunities for growth and change. You…

Ultimate Guide | How to combine finances with your partner.

We get it. Talking about money with your partner can feel weird. But we promise it’s easier than it seems. And what’s more? Once you start the conversation, you’ll soon…

Managing Money With a Baby on the Way

Learn how to budget and save to reach your growing family's financial goals.

Explore topicLearn how to budget and save to reach your growing family's financial goals.

How do Registered Education Savings Plans (RESPs) work?

Natasha Mills is a devoted mother to an incredible new set of boy-girl twins named Mila and Liam, along with her amazing five-year-old son, Hudson. With a bachelor’s degree in…

How to navigate money management as a single parent.

Natassia Valli takes great pride in being a dedicated mother to her two adorable boys, Qaayam (fondly known as Q) and Areez (lovingly referred to as Ari). Together, they reside…

WEBINAR | How to manage money with a baby on the way

Making the decision to expand your family is exciting! But as you know, it requires some planning. And for that–we can help. In this guide, we’ll walk you through the…