Reaching your long-term goals is hard enough. But trying to do all that while taking care of your day-to-day needs? It can feel impossible. By paying yourself first, though, you can use dollar-cost averaging and compound interest to build the future you really want.

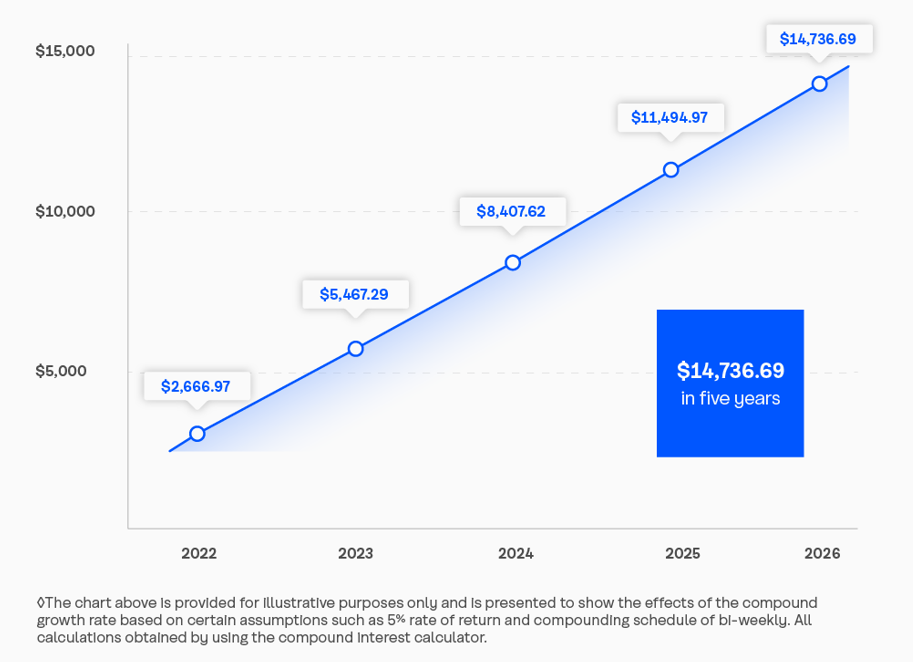

For example, if you invest $100 every two weeks into a balanced investment, assuming a consistent 5% return, your investment could grow to over $14,000 in just 5 years.

We’ll show you how. Let’s start by explaining the concept of “paying yourself first” and why it can be so important.

What does it mean to pay yourself first?

A new car. A home to call your own. Your child’s education. Whatever your goals are, you can put them within reach when you have the right financial plan. And it all begins by paying yourself first – making sure you’re saving towards your long-term plans before you take care of anything else.

There are a couple of ways to do this:

- The first options is the hardest to maintain. Whenever you receive a direct deposit from work, you can take some of that money and put it into a savings account, a Tax-Free Savings Account (TFSA) or your Registered Retirement Savings Plan (RRSP). This method can fall apart quickly if you don’t keep up the habit.

- The second, easier option is to set up automatic transfers from your chequing account to another on the days you’re scheduled to get paid or whenever makes the most sense for your financial situation. These transfers are referred to as pre-authorized contributions (PACs).

Whichever option you choose, the benefit is that you stay on track with your plans, while leaving enough behind so you can also take care of everything from credit card statements to phone and internet bills, rent and more.

What is dollar-cost averaging?

For longer-term goals, paying yourself first works especially well when the money you’re saving is used to automatically purchase investments, like mutual funds. This leads to dollar-cost averaging, an effective way to cut costs on your financial plans.

It might seem counterintuitive, because people often assume that the way to get ahead with your investments is to time the market just right. However, by regularly purchasing investments, like mutual funds, with the same amount of money, you’ll be buying fewer units when prices are high, and more units when prices drop. Over time, this will save you money because you “average out” the costs while earning money from the long-term growth of the investments you regularly purchase.

What is compound interest?

Paying yourself first not only benefits you with dollar-cost averaging, but compound interest, too. When you invest money into a savings account, a TFSA, an RRSP, or similar accounts, you earn interest based on a percentage of the amount you have in the account so far.

Interest grows the amount you have saved over time. Since your interest is based on a percentage of the invested amount, you will soon find that you are earning interest on top of the interest you’ve already earned. It’s compounding.

Talk to a financial advisor.

By paying yourself first, you can use dollar-cost averaging and compound interest to achieve similar results to those in the chart above. Get started by speaking with a trusted financial advisor.

We’re here to help.

Everyone’s financial situation is unique. The financial advice you receive should be unique, too. Speak with a Coast Capital advisor to find out more about how knowing when to save and when to invest can affect your financial plans. We’ll take the time to understand your unique needs and goals and help you craft a plan for achieving them. Visit a Coast Capital branch or call us at 1.888.517.7000.

Coast Capital Savings Federal Credit Union provides advice and services related to deposit, loan, and mortgage products. Coast Capital Wealth Management Ltd provides investment and financial planning services. Coast Capital Financial Management Ltd. provides advice and service related to segregated funds, annuities, and life insurance products. Worldsource Financial Management Inc. provides advice and service relating to mutual funds. Mutual fund values change frequently, and past performances may not be repeated. Commissions, trailing commissions, management fees and expenses may all be related with mutual fund investments. Important information about mutual funds is contained in the relevant fund facts and simplified prospectus. Please read the fund facts carefully before investing.

The stuff we have to say.

This article is provided for general information purposes only. It is not to be relied upon as financial, tax, or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this article, including information relating to interest rates, market conditions, tax rules, fees, and other investment factors is subject to change without notice and Cost Capital Savings Federal Credit Union is not responsible to update this information. All third-party sources are believed to be accurate and reliable as of the date of publication and Coast Capital Savings Federal Credit Union does not guarantee the accuracy or reliability of such sources. Readers should consult their own professional advisor for specific financial, investment, and tax advice tailored to their needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.