1. Max it out

Start by making the largest contribution you can before the 2024 RRSP deadline on March 3, 2025. That way, you’re getting the biggest tax deduction possible. The Canada Revenue Agency (CRA) sets a limit on how much you are allowed to deposit into an RRSP every year. For the 2024 income tax year, the RRSP deduction limit is 18% of your earned income, up to a maximum of $31,560. Since RRSP contributions are subtracted from your gross income, the more you contribute, the less tax you probably owe.

2. Cash in on unused contributions

Since unused RRSP room never expires and roll over into future years, you may have more contribution space than you think. Don’t let it go to waste! Check your CRA account and top up any unused contributions from past years ASAP.

3. Take out a loan

Got ample RRSP room but short on cash? An RRSP loan might be the answer. You can borrow money to put into your RRSP, which gives you a higher income tax deduction. It’s a savvy strategy for putting your money to work, especially for high-income earners or those who can repay the loan within 1-2 years.

4. Get the worm

Don’t wait until the tax deadline – contribute to your RRSP early and often. Deposit a lump sum payment at the beginning of the year, or if you prefer, make smaller, regular deposits each month. This puts time on your side: the sooner you save, the more time your money has to compound tax-free.

5. Invest your RRSP

Location is everything in real estate – and the same applies to where you park your RRSP savings.

Given that a diversified, balanced investment portfolio could fetch you 5% annually or more, investing in your RRSP is the best way to unlock its full power. Aside from a registered savings account, your RRSP account can hold any type of investment product, such as GICs, stocks, bonds, mutual funds, and more. Coast Capital offers a range of options: from market-linked GICs to Coast Capital® Mutual Funds–including a suite of Sustainable Investing solutions available, so you can align your investments to your values.

6. Set it…

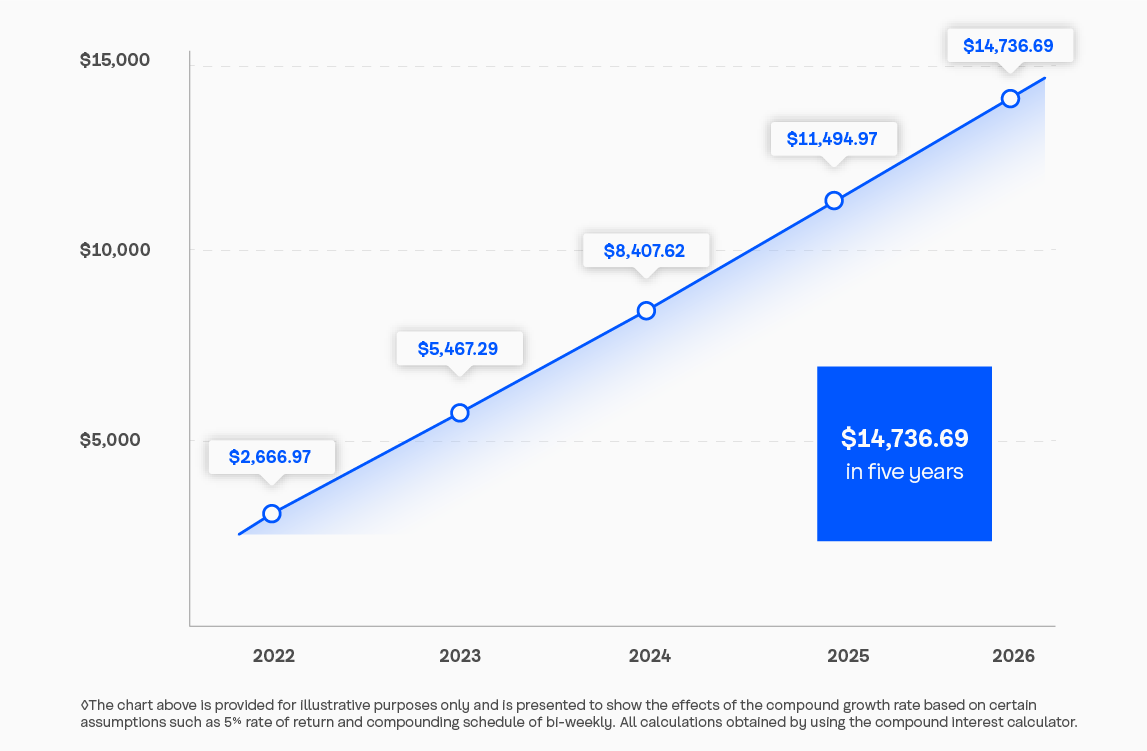

A secret to successful saving is to “pay yourself first.” In other words, schedule a pre-authorized contribution into your RRSP account on a regular basis each month. Automating your savings removes the temptation to blow hard-earned dollars and forces you to save instead. It also means you can lessen the impact of market highs and lows on your mutual funds when you invest in the same amount regularly with “dollar-cost averaging.” This approach brings down the cost of individual mutual funds over time and makes budgeting easier because you’re always paying the same amount. Plus, saving through regular contributions over time gives you the benefit of compound interest – where you earn interest on your initial investment and you earn interest on your interest. That means if you invest $100 every two weeks into a balanced investment, assuming a consistent 5% return, your investment could grow to over $14,000 in just 5 years◇.

7. …and forget it

Once you’ve got into the groove of saving, keep your hand out of the money jar. The goal is to save for the long-term and only access the funds once you’re ready to retire or if you want to purchase your first home through Canada’s Home Buyers Plan. Early RRSP withdrawals incur a hefty withholding tax ranging from 5% to 30% (depending on your province/territory). Plus, you risk losing out on earning compound interest, and once you withdraw an RRSP, you can kiss that contribution space good-bye. CRA doesn’t give it back.

8. Take a test drive at tax time

Another smart strategy is to do your taxes before the RRSP contribution deadline in March. Even if you don’t file right away, take a “test drive” in January and see if any last-minute RRSP contributions might decrease your taxes owed or even get you a refund. Some income tax software even offers RRSP calculators that estimate how different contribution amounts might impact your taxes.

9. Reinvest your refund

As tempting as it is, don’t spend your tax refund! Instead, add it to your RRSP contributions. That way, you’re using the tax benefit to “top up” your investments.

10. Enlist help

Got burning questions about RRSPs and retirement planning? Our team of experts can help assess your unique financial needs and goals: from determining whether an RRSP loan is suitable to creating a personalized investment portfolio with the right asset allocation. Book a quick chat with a financial expert and let us help you get started on your saving journey.

The stuff we have to say.

Coast Capital Savings Federal Credit Union provides advice and service related to deposit, loan and mortgage products. Only deposits held in Canadian currency, having a term of five years or less and payable in Canada are eligible to be insured under the Canada Deposit Insurance Corporation Act. Coast Capital Wealth Management Ltd provides investment and financial planning services. Coast Capital Financial Management Ltd. provides advice and service related to segregated funds, annuities and life insurance products. Worldsource Financial Management Inc. provides advice and service relating to mutual funds. Mutual fund values change frequently and past performance may not be repeated. Commissions, trailing commissions, management fees and expenses may all be related with mutual fund investments. Important information about mutual funds is contained in the relevant fund facts and simplified prospectus. Please read the fund facts carefully before investing.

Saving for retirement might seem straightforward on paper, but truthfully, there’s an art to building your “RRSP empire.” In fact, many Canadians still struggle to understand registered retirement savings plans and how to make these tax-deferred vehicles work for them. Follow these ten tips for growing your RRSP and you’ll be on track to achieving your financial goals in no time.