Investments are a key part of any financial plan and investment strategy needs to change and mature as you do. Someone who is 60 is going to have a very different investment strategy than a 20-something investor.

Here are some things to consider as you and your investments move through the years.

Investment Mix

Investors should look at the following when assessing their investment strategy:

- Goals – Define your goals and what you need to do to reach them

- Time frame – Consider when you will need to tap into your money

- Balance – Find the right balance between risk and your expected rate of return

- Comfort – Ensure that you’re comfortable with the level of risks you are taking on

- Flexibility – Make sure that your investments are easily accessible so that you can make adjustments to your investment mix over time, based on your overall situation, income needs and your financial goals

Life Stage

Depending on your life stage, there are different things to keep in mind.

Mid-twenties to mid-thirties

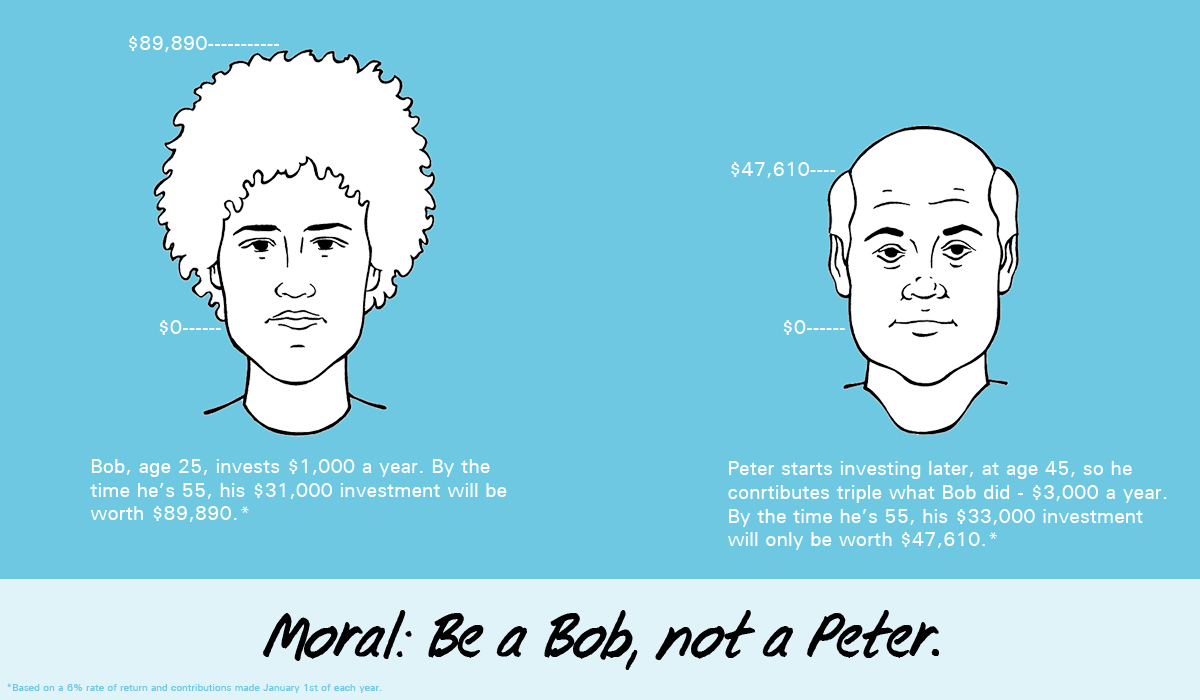

In your early working years you aren’t going to have a lot of money to allocate to each of your budgetary buckets, so investing may not be a top priority. But a little goes a long way, so if you can budget even $20 a month into an investment portfolio to start, it’s a really good idea. This is a great time to start taking advantage of compound interest. It makes a big difference in your return over time.

Middle years

During the middle years you are probably earning a good wage but these are also the years where you have a lot more financial responsibilities. You most likely own a home, you have children to support and RESPs to contribute to and on top of that, you’re more aware of the need to save for retirement. If you haven’t already, setting up a recurring automatic transfer to your savings or RRSP is an easy way to make sure you’re budgeting for your savings goals regardless of your age. And if you’ve been contributing to your RRSP but it’s sitting in a savings account, it could probably be doing better. Consider moving it to an investment product with a higher potential return.

Later years

In the later years, you’ll be looking to move your investments into more predictable options with a greater emphasis on safety and income, and some of your options may include guarantees. You are now approaching the point where you’ll have to tap into that money to help you fund the best possible retirement. It’s a great time to review your investment strategy again to chat about what’s next. If you’ve been working with a planner from the get-go, there should be no surprises – only sweet, sweet victory in your nearing retirement.

As you just read, there are many things to consider when looking at your investment strategy. There are things you can do – like picking a financial planner that truly cares about your financial well-being, setting up recurring automatic transfers, and reviewing your portfolio regularly – that will make sure you’re on the road to a comfortable and happy retirement.

Ready to make it happen? We’re here to help, just give us a call or book an appointment.