Investments are an important aspect of any financial portfolio—especially when looking long term. So, how can you squeeze the most out of your hard work? Read on to learn how investments can help you reach your goals.

Set financial goals

Everyone should invest in themselves and their future. But it all truly goes back to what your goals are.

When you’re saving, always have a goal in mind. Think about the question: what does financial well-being mean to you? Whether it’s to own a house, buy a car, retire early or take care of your luxurious collection of garden gnomes—that’s your call. Whatever it means to you, it’ll motivate you to keep saving.

We get it, goal setting can be tough. Try to start by setting SMART goals. Make them Specific, Measurable, Achievable, Relevant and Timely. This way you can track your progress and maybe even reward yourself a little along the way.

Why invest?

To meet long-term financial goals, you need your money to grow. Earning interest is one of the primary reasons people invest their money. It helps your bank account keep up with inflation. Ultimately, the idea is that you end up with more than you put in.

Investing is like saving with a super-hero cape on. But you have to let it do its thing. It’s typically meant to be used as part of your long-term savings strategy, so you can take advantage of a little thing called compound interest (that means more money for you).

What age should you start?

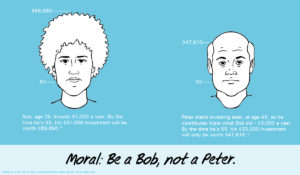

The earlier, the better. You might be thinking “I’ll do it next year” or “life’s too busy to invest right now” but now is the time to do it.

Let’s compare someone who is 20 years old and invests $100 a month vs. someone who is 30 years-old but invests $200 a month to make up for the past ten years. In the end, the 20-year-old will always have more money than the 30-year-old. Why? Compound interest. The 20-year-old’s money had ten extra years to grow and earn interest.

Create a pre-authorized payment

Set up monthly contributions –even if it’s just $25 a paycheque. This will help you budget and stay committed since you barely need to think about it – it’ll just happen automatically. You should adopt a “set it and forget it” mindset. It also makes investing less scary when you do it monthly or bi-weekly. Because it’s a smaller amount, it’ll seem less drastic of a hit on your bank account. Rather than waving good-bye to $600 once a year, it’ll be much easier to part with $25 every two weeks.

Stick to the plan

One thing to know: the market will always go up and down. It’s hard not to listen to your brain when it tells you to press the flashing red “withdraw” button when you see your investments dip in value. But don’t let the emotional rollercoaster cloud your judgement.

I always ask my members to consider this: If your home is worth one million today but tomorrow it drops to $800K, would you sell your home? No. You would wait for the market to correct itself—unless you absolutely had to sell or move.

Stick to the plan and re-evaluate every year with your financial advisor to make sure this is still the right fit for you.

Talk to the experts

Do your research and ask questions but more importantly, talk to the experts. In the past I’ve found that people are worried about looking silly when asking questions, so they walk away feeling confused or overwhelmed. I want members to always feel like they understand what they are doing and why. As advisors, we’re here to learn what your goals are, make investing simple and empower you to achieve what’s important in your life.

No matter what stage of investing you’re in, our accredited investment team can help – whether you’re just getting started, a seasoned investor or somewhere in the middle. Get in touch or call us at 1.888.517.7000 and we’ll help figure out what’s right for you.