While there’s no such thing as an investment magic 8 ball to help you invest your hard earned savings, there are some key rules our experts advise you to follow. We call them the four pillars of investing. Regardless of whether you’re new to investing or have had investments for a while, they’re great rules to follow.

And don’t worry; it’s not a phone-book sized manual full of complicated mumbo jumbo. That’s just not our style.

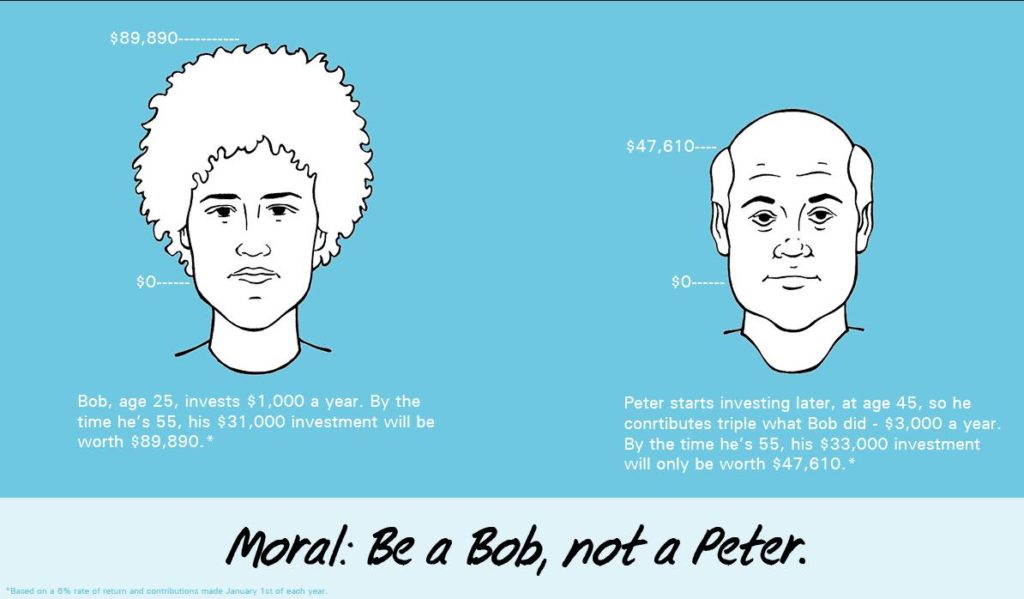

Invest Early

The earlier you invest, the better. That’s because of a little thing called compound interest.

Compound interest is when the interest your money makes earns its own interest and ultimately allows your investment to grow even faster. Regularly investing a small amount earlier adds up far better than investing a larger amount for a shorter length of time. That means if you haven’t started, start today.

There won’t be a time machine to take you back 10 years, but in 10 years from now, you’ll be happy you started when you did, even if it felt like you were a little late in the game.

Invest Often

Investing often means setting up a scheduled regular contribution— you can do this through a pre-authorized credit (PAC)—to your long term investment accounts.

Contributing regularly ensures that you always have a set amount going into your long-term investments. It’ll help you budget for your savings and take advantage of dollar cost averaging. What’s dollar cost averaging? We’re glad you asked. If your investments are in mutual funds or other market-based investments, a PAC will ensure you purchase when the market is both up and down. That’s dollar cost averaging – you don’t have to worry about paying attention to the best time to enter the market— it all averages out in the end.

Diversify

Diversification is making sure that your investments are made up of different types of assets in many different sectors of the market. As different assets and sectors of the market perform differently, a well-diversified portfolio is a lower risk portfolio than one that only holds a small number of assets or sectors.

Stay Invested

Say it with us: Stay invested. Work with a financial advisor to set up your investments and avoid making any big changes. Basically, set it and forget it. It can be hard to watch your investments go down in value, but markets will have both up and down times. If markets dip, don’t push the panic button. Time and time again, history has shown us that the best strategy is to stay invested through the highs and lows.

If you are ready to get started but want a hand, give us a shout and we’ll be happy to walk you through your options.