This article is also available as a downloadable PDF, which includes a customizable template to help you apply these tips to your business. Download Here: Coast Capital – Gross Profit Break Even Template

This calculation will identify the gross profit and total sales your business needs to cover overhead and break-even. It’s useful if you sell multiple products and services, which makes it difficult to allocate specific overhead to one product or service.

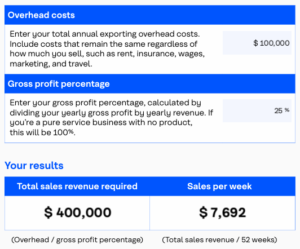

Overhead costs

Enter your total annual exporting overhead costs. Include costs that remain the same regardless of how much you sell, such as rent, insurance, wages, marketing, and travel.

Gross profit percentage

Enter your gross profit percentage, calculated by dividing your yearly gross profit by yearly revenue. If you’re a pure service business with no product, this will be 100%

How to change your results

Lower overhead or improve your gross profit percentage by, for example, increasing price or decreasing labour and materials. Each appraoch will impact how much you need to sell in order to break even.

Below is an illustrative example for a business with $100,000 in overhead costs, and a target 25% Gross profit percentage. The template can be downloaded here: Coast Capital – Gross Profit Break Even Template

The Stuff We Need To Say

This content is for general information purposes only. It is not to be relied upon as financial, tax, or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. You should consult your own professional advisor for specific financial, investment, and/or tax advice tailored to your needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.