Your RRSP Questions, Answered

The things you need to think about when it comes to your RRSP will differ based on your life stage and investment history. You’ll have different questions if you’re nearing…

RRSP vs TFSA. Which is better for you?

The great debate: TFSA vs RRSP With the RRSP contribution deadline just around the corner, it’s important to know about all your savings options. Today we break down which savings…

Top 10 Ways to Grow Your RRSP

Saving for retirement might seem straightforward on paper, but truthfully, there’s an art to building your “RRSP empire.” In fact, many Canadians still struggle to understand registered retirement savings plans and how…

Tips for making your last minute RRSP contribution

You can make contributions to your RRSP all year long–but in order for them to count towards your 2025 tax return and lower your overall taxable income for last year:…

How a loan can put you on top during RRSP season

The RRSP contribution deadline is just around the corner. Come March 2, 2026, it’s a ‘snooze you lose’-type situation if you want your contribution to count for the year. Like…

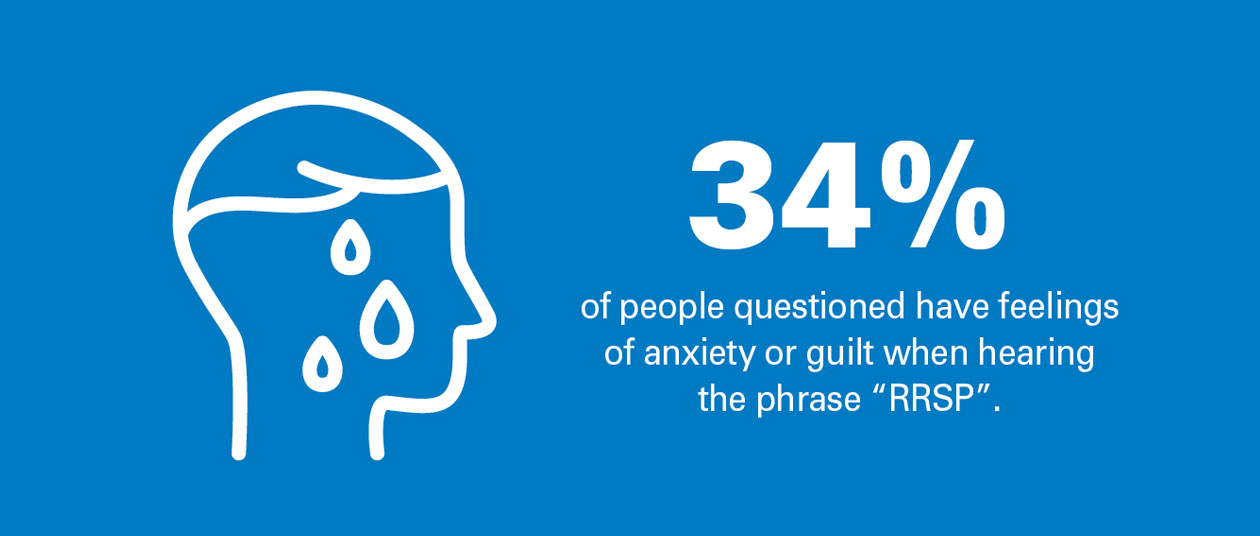

Feeling stressed about RRSPs? You’re not alone.

As March 2 approaches (that’s the RRSP contribution deadline for the 2025 tax year), many British Columbians experience feelings of guilt and anxiety just thinking about retirement savings. We recently…

Using your RRSP for things other than retirement

You probably know that you can use an RRSP to save for retirement. But have you considered other ways you can tap into these savings? Read on to find out.…

Understanding the spousal RRSP.

With the new year comes new RRSP considerations. Your mind shifts to thinking about your Registered Retirement Savings Plan (RRSP) and the ability of it to lower your tax burden.…

Guide to maximizing your 2022 year-end contributions.

Celebrations, shopping, gifting, vacations—the holidays often conjure up more reasons to spend than to save. But the end of the year actually presents a good opportunity to shore up financial…