There are more ways for small businesses to access lending today than ever before, but choosing the right financing option can tricky.

Sometimes business owners will consider dipping into their personal finances, leveraging friends or family as support, remortgaging their home to fund their business, or going to their branch for a traditional business loan.

These options might be the quick and easy way of doing things but it’s not always the right decision for your business. Here are a few things to think about before you decide on one of those options:

- You might not have the capital available to you to rely on your own nest-egg to fund your business.

- Relying on friends and family sometimes can become complicated when involving your business.

- Refinancing your personal assets might impact your ability to build a strong business credit profile in case you need it in the future.

- Applying for financing in-branch could be a lengthy turn-around with a long documentation review process.

There are a lot of times when an opportunity knocks and you need financing quickly. Luckily you have other options like terms loans, factoring, merchant cash advance, or even lines of credit that small businesses can use to access capital.

One of the best parts of living in a digital age is that many of these options are also available online like quick financing through OnDeck, our trusted lending partner. No need to book an appointment. You can apply in minutes when it’s convenient for you and receive funding in as little as 24 hours.

Whether it’s an OnDeck short-term loan that gets you fast access to working capital or one of our other tailored small business solutions – these are the questions to contemplate when you’re evaluating your financing needs:

1. What’s your financing goal or objective?

The answer to this question will set you on a path towards clarity for any follow-up questions. Why are you borrowing? What’s the purpose of this loan? Do you have a goal in mind?

If you can’t clearly define what you are borrowing for, it’ll be harder to find the right business loan for your situation.

How much you borrow depends heavily on the end goal of the money as well. For example, borrowing to purchase inventory to help you through a seasonal cash flow gap, is different from borrowing to add a new location across town or purchase an expensive piece of industrial equipment.

The financing you choose should fit the business goal you’re trying to meet. In other words, the length of term and interest rates should fit well with the purpose of your loan.

2. How long do I need the funds to achieve my goal?

The time frame is important. Figuring out if it’s for the long-term or short-term might seem easy, but it’s a detail that sometimes gets overlooked. The financing terms you choose should fit the business use case you’re trying to meet.

Short-term

If you need a loan for something that you’ll most likely be able to pay back in about year, your best bet is a short-term loan.

For example, a four-year term loan to purchase inventory that has a quick turnaround time of six months might not be the best way to finance that purchase. A shorter-term loan might be more appropriate for that use case.

Long-term

If your purchasing something that could take years to pay back, then obviously, a longer-term loan would be needed.

For example, purchasing a new building or buying a new CNC milling machine could be considered a longer-term need because they’ll likely take a few years to pay off.

3. What interest rate makes sense for my financing goal?

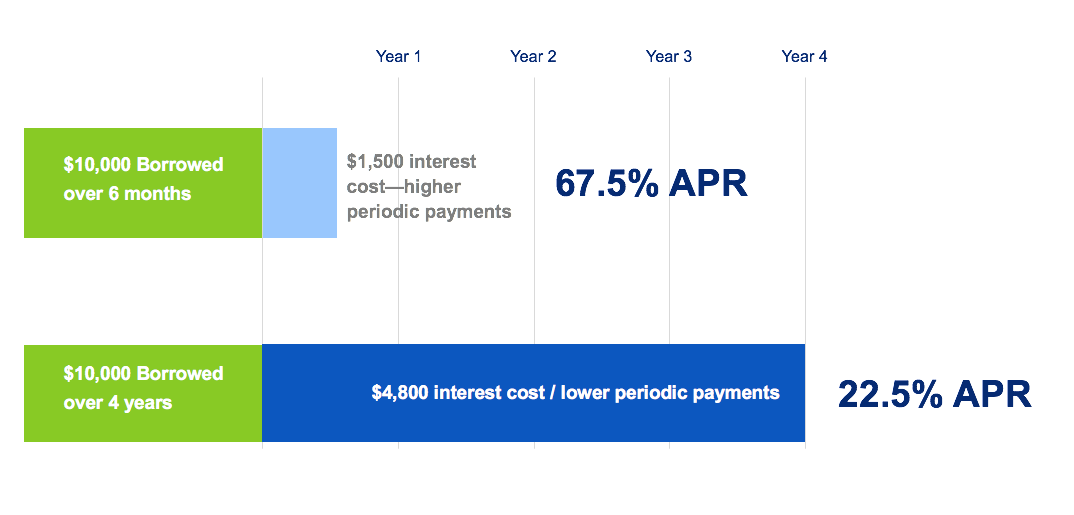

As a general rule, you should expect the payments to be higher for a short-term loan, but at the end of the day, the cost of the loan will likely be less because the accrued interest payments are less. For example, what if the total dollar cost of a 67.5% annual percentage rate (APR) loan could actually be lower than a 22.5% APR loan?

Borrowing $10,000 over six months at 67.5% APR will have $1,500 in total interest costs compared to borrowing the same $10,000 for four years at 22.5% with a total interest cost of $4,800. If you were borrowing to fill a short-term need, like purchasing inventory, the lower total interest cost of the shorter-term loan (even at the higher APR) would allow a higher return on investment (ROI) on the borrowed capital.

Once you have a goal in mind for your loan, you can identify whether or not the interest rate and the overall cost of the loan make sense for you and your business needs. And, in addition to APR, there are a handful of other metrics you should use to compare loans including:

| Total Cost of Capital | This metric includes all interest and any other fees that are a condition of receiving capital. This metric discloses the total dollar cost of the finance option, a crucial source of information for a small business owner borrowing for a use case that includes a defined ROI. |

|

The Average Monthly Payment |

This metric reflects the average monthly cash flow impact of repaying the finance option being considered. Regardless of whether the periodic payment is daily, weekly, or monthly, the average monthly payment provides a common benchmark for evaluating the monthly cost. |

|

Cents on the Dollar |

This metric identifies the amount of interest (or Loan Fees, as applicable) paid for every dollar borrowed. This metric is exclusive of all other fees to allow for comparison with other common pricing metrics in commercial finance, including the factor rate, simple interest, and total interest percentage. |

|

Prepayment Conditions |

Will there be additional fees or charges for prepayment and if there are, what will they be. Will prepayment result in any reduction in interest or applicable loan fee? |

These are important questions to ask your lender before you sign on the proverbial dotted line.

Comparing APR is a good way to compare loans of similar terms, but when comparing loans with different terms or financing options that might not express their costs in terms of APR, the above metrics will help you make an apples-to-apples comparison so you can make an informed decision.

4. What Does My Credit Profile Look Like?

In addition to your loan goal, understanding what your credit profile looks like will help you decide where to look for a loan. For most small business owners, on top of your business credit profile, your personal credit score will likely be part of any creditworthiness decision.

For example, most traditional financial institutions want to see a personal credit score in the 700s—sometimes they’ll go as low as 680 if the business’ financial position is good.

However other lenders, such as OnDeck, will work with a borrower who has a healthy business to evaluate real-time business performance across thousands of data points, even if you’re unsure of your credit score. A strong credit profile isn’t a guarantee you’ll get the financing you’re looking for, but it does improve your options and the odds of finding success.

When evaluating your business’ creditworthiness, lenders are basically looking for the answers to three questions:

| Can this business repay a loan? | Lenders need to double check if you have the revenue and cash flow to pay off the debt. This is why most lenders will want to review your business financial reports. |

|

Will this business repay a loan? |

This is when your credit profile matters. Lenders are trying to make decisions about what you’ll do in the future based on what you’ve done with your credit history in the past. |

|

Will you be able to make each and every payment? |

Regardless of success after the loan is given, will you be able to make all the payments? Traditional lenders often need collateral and a personal guarantee to lower the risks associated with lending. But many online lenders don’t require specific collateral. Instead, they’ll likely require a general lien on business assets and a personal guarantee to secure the loan. This allows a healthy business and a good borrower to access capital even if they don’t have assets the lender would consider as collateral. |

Ready to get started?

Answering all these questions will help you make an informed decision so you choose the loan that’s right for your business.

You can also rely on your trusted Financial Advisor to look over these details and recommend what may be the best option for you, to help make your financing experience friction-less, so you can feel confident and informed in your business financing decisions.

We’re here to help. Get in touch to learn more about your business financing options and what options are for you and your business.