Even though taking on debt is incredibly common, and in some circumstances even expected in order to run and grow a business, that four-letter word still causes entrepreneurs a lot of dread. And we get it, it’s hard to plan for the future when debt feels like it’s holding you back. But the good news is that debt is not a life sentence. By working with the right partners, and keeping track of a few key things, you can put a plan in place to better balance your books in no time.

How to manage your debt.

1. Don’t do it alone.

The most important first step you can take is to make sure you have the right partners in place to help you manage your debt. You started your business to do exactly that—run your business. Don’t put any pressure on yourself to be your own accountant and financial advisor too. Connecting with these experts is the best way to ensure that you’re making smart money moves for your business. When getting started, make sure you:

- Work with your accountant to find out which class of debt you should pay off first

- Then connect with your financial institution to review your books and pinpoint any debt consolidation opportunities.

2. Make a new business budget.

Now that you have the right partners in place, it’s time to take another crack at your budget. Even if you already have one in place, it might be time to make a new one—especially if your debt is keeping you up at night with your current budget. We can help you create one that offers a little more peace of mind. First, read our small business budget guide, then work with your partners (your advisor and accountant) to:

- Total your debt

- Map out your cash flow—how much is coming in vs going out?

- Nail down a realistic monthly payment plan

3. Schedule a timeline.

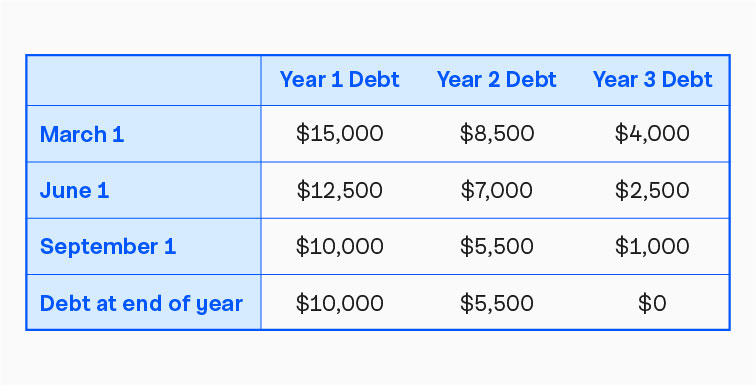

Once you’ve mapped out your cash flow and a realistic monthly payment amount, you can work with your financial advisor to sketch out a debt repayment schedule to keep you on track. It might sound complicated, but your advisor will do a lot of the heavy lifting here during your planning conversation. In the end, you’ll walk away with an actionable plan and a time frame to track your progress against. For example, if you have $15,000 in debt and decide with your advisor that you can realistically pay off your debt in three years, a debt reduction timeline could look as simple as this:

3 places to find wiggle room for monthly payments.

When you’re working through Step 2 with your advisor and accountant, you’ll work together to identify opportunities to reduce your bad debt, increase your good debt, and optimize the way you spend your outgoing cash. Some of the most common ways of freeing up extra cash flow your partners are likely to recommend include:

1. Consolidating your debt.

For businesses with lots of credit card debt or multiple small business loans, debt consolidation is a great way of swapping bad debt (high-interest) for good debt (low-interest). Your financial advisor can walk you through different lending options with better lending rates to help you pay off your high-interest debts first.

2. Lining up your payables and receivables.

Freeing up cash flow can sometimes be as easy as taking a hard look at your payments and receivables schedule. When you’re building your monthly budget with your financial advisor, they’ll work with you to make sure all of your outgoing monthly payments align with your incoming cash flow. It may seem obvious, but sometimes even a few of these adjustments, so they better overlap, can free up cash.

3. Renegotiating your terms.

If your cash flow is super tight, and you’re willing to explore any avenues that give you some breathing room, consider working with your accountant to renegotiate terms with your vendors and lenders. Pick up the phone and have a direct conversation with them about opportunities for discounted early bird payments on new purchases, or maybe even extend payment terms on outstanding invoices.

You can also try the same tactic with your lenders—get in touch and see if it’s possible to restructure payments or negotiate interest rates. Be sure to work closely with your financial partners if you decide to go this route because it will affect your credit score.

Debt is not a life sentence.

We know we already said that at the beginning, but it bears repeating. All businesses take on debt at some point, because that’s the nature of the operation. Granted some take on much more than others, but there’s always a way out as long as you’re willing to have an honest conversation with your financial partners.