There are many times in life where borrowing money will be necessary. For example, you might want to buy a car, do home renovations, or consolidate debt. The good news is that there are so many different options available, such as a personal loan or a line of credit (LOC). They each have their uses, which is why you’ll want to know the differences. This primer will help you get the most out of these lending opportunities.

How a personal loan works

A personal loan is a lump sum that’s typically provided by a financial institution. In order to get access to those funds you need to agree to repay the lender interest on your payments. Here are a few key things to be aware of when considering a personal loan:

- Payment frequency: In many cases, the payment frequency can be chosen. Some of the most common frequencies are weekly, bi-weekly, or monthly.

- Terms: Quite often, personal loans have a fixed term. Once you’ve made all of your payments, your loan is paid off.

- Secured or unsecured: Personal loans can be secured or unsecured. With an unsecured loan, banks are taking on more risk by lending to you, so most likely they’ll charge a higher interest rate. Whereas with a secured loan, such as a mortgage or auto loan, you’d be charged a lower interest rate since the loan is backed by collateral.

- Personal finances: It all depends on your personal details when it comes to how much you can borrow and your interest rate. Your credit score, credit history, income, and outstanding debt are all considerations that lenders factor in. Someone with an excellent credit score and high income will likely be approved for a bigger loan with a lower interest rate compared to someone with a history of debt. This could also impact whether the interest rate on the loan is fixed or variable.

How a line of credit works

A line of credit (LOC) is similar to a personal loan, but instead of getting a lump sum, you get a credit limit that you can draw on at any time. One of the benefits of a line of credit is that you’re only charged interest on the amount you withdraw instead of the entire amount like with personal loans. Here are a few more points concerning a line of credit:

- Interest-only payments: In most cases, you’re only required to make interest-only payments when borrowing from your line of credit. However, if you don’t make an effort to pay back the amount you initially borrowed, you’ll always owe the principal. So it’s best to pay as much as you can and bring the amount you owe down.

- Favorable interest rates: The interest rate on a line of credit is often variable, and it can be both secured and unsecured. Using a personal line of credit for debt consolidation is an excellent idea since the interest rate is often much lower compared to most credit cards.

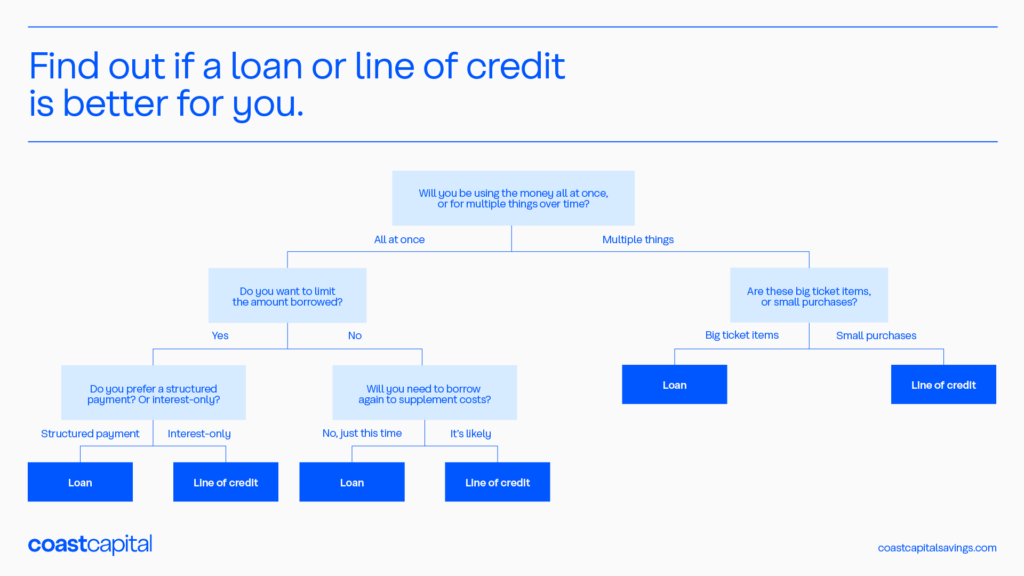

Choosing between a personal loan and a line of credit

In many cases, you may choose the option that gives you a lower interest rate. By doing this, you’ll be paying less overall. That said, it’s not always so simple as there are other considerations to factor in:

- Borrowing needs: A personal loan is ideal for people who have a specific borrowing need in mind, such as paying for tuition. Since you’re getting the money upfront, you can immediately pay for the purchase and then have the payments come out of your account based on your preferred schedule.

- Flexibility: On the other hand, a line of credit is great for anyone who wants flexibility. Unlike a personal loan, you only need to apply for a LOC once. You can withdraw from it as much as you like as long as you don’t exceed your limit.

- Repayment plans: You also need to think about the repayment schedule. With a personal loan, you’re going to have set payments, so it’s a good choice for people who need help budgeting. However, since a line of credit usually only requires interest-only payments, you need to be disciplined and remember to pay off the principal.

Choosing between secured and unsecured loans

When deciding between a secured or unsecured loan, think about the following terms:

- Secured loans: Since secured loans are backed by collateral, you can usually borrow more and sometimes get a lower interest rate. The approval process can take longer since your collateral needs to be verified, but the money saved can be worth it. There may also be administration or legal fees that need to be paid.

- Unsecured loans: With unsecured loans, the approval process is faster. In some cases, the entire process can be done online. Once approved, you’ll be able to access the funds right away. That said, you’ll likely need to have a good credit history to get approved. Home renovations, debt consolidation, and paying tuition are the most common reasons people use unsecured loans.

How to apply for a loan or line of credit

Regardless of what your borrowing needs are, it’s a good idea to speak to a financial adviser who can clearly explain what options you have according to your financial situation. Then you can apply for a loan online. Or if you want more details first, book a chat with a Coast Capital adviser to get a breakdown of what each product offers and decide which one makes the most sense for you.