The best way to avoid spending any money in December is by turning down every invite, staying at home, and shutting the blinds.

We say bah humbug to that.

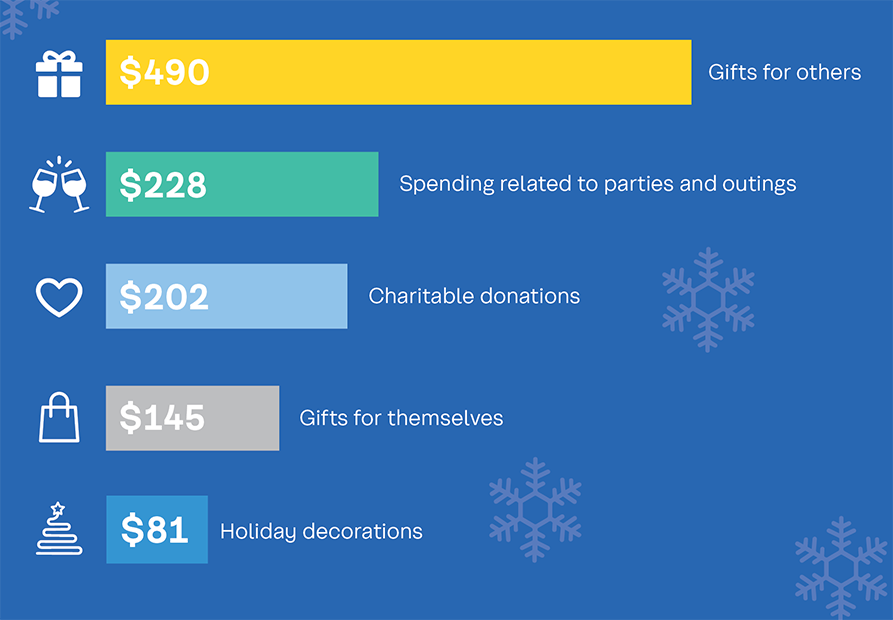

But in all honesty, we know that spending money during the holidays is inevitable. A new poll hosted on the Angus Reid Forum for Coast Capital reports that on average, respondents predict they will spend a total of $921 this holiday season. Here is a breakdown of where that money is going:

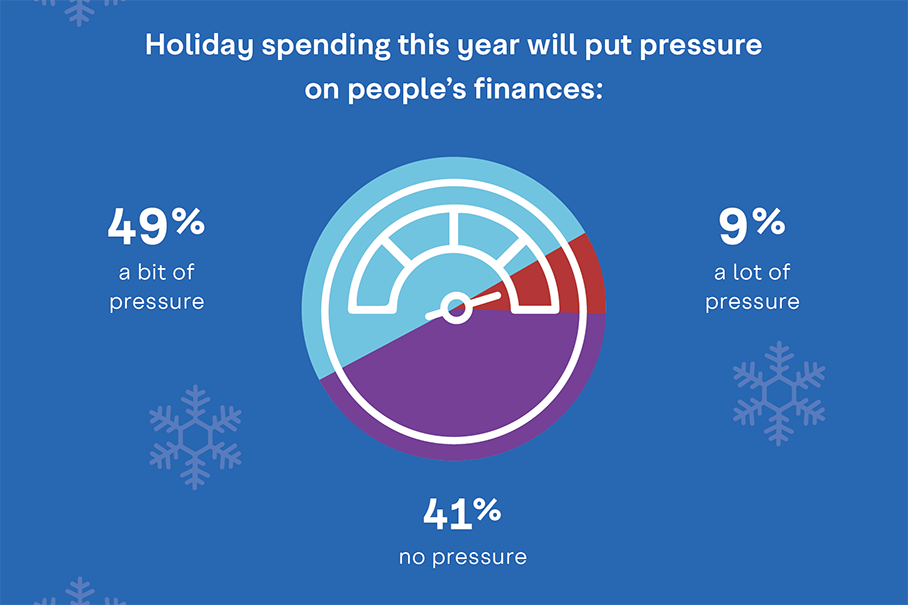

That same poll found that over half of us feel financial pressure during the holidays. We can help with that.

Creative ways to save money

- Happy hour means a happier wallet

Avoid peak hours at restaurants and bars by going during Happy Hour. You still get the same experience but for a much lower price. Happy Hour is usually from 2pm until 6pm or 9pm until late.

- Cash only

Make a list of who for and what you’ll buy this year. When you go shopping, take out that total in cash and leave your credit cards at home. This will help you to avoid over-spending and impulse purchases.

- Buy consignment

You save money and the planet. Consignment shops don’t just sell clothes. You can find books, trinkets, and other cool gifts. There are so many consignment stores, a quick google search will help you find one near you.

- Gift of time

Holidays aren’t just about material things. Sometimes, gifting your time or a skill set is just as valuable, for example, if you’re a carpenter you could offer one free repair. If you have friends who are parents, maybe you could babysit for a night—the greatest gift of all.

- Re-gift

No shame in the re-gift game. As the saying goes, one person’s trash is another person’s treasure. Don’t feel bad about re-gifting presents you receive earlier in the month or gifts you’ve received previously but have never used.

If you need help from the experts or just a quick review of your budget, give us a shout. We’re here to help.