Who doesn’t like sitting in the sun (or shade) passing the time with a good book? I’m all for getting lost in a good fiction every once in a while, but I’m also an advocate for continuous learning. So this summer, let your next read be one that will benefit you financially. Here are my top three picks for finance books to dig in to this season.

1. Grit: The Power of Passion and Perseverance by Angela Duckworth

What you’ll learn

Grit reveals that the secret to success is not always IQ or talent, but picking something and giving it your all. This isn’t like typical finance books – it doesn’t really talk about money at all. Instead, it focuses how you can excel in key areas that impact your ability to earn income so by developing grit, you can improve your financial well-being. But what is grit, you ask? Duckworth likens it to the combination of both passion and perseverance.

Why I love it

I love that Grit isn’t about money – there are no financial principles or money tips in this book.. It’s all about hard work and perseverance. Everyone can benefit from this book – IQ may be fixed, but we can all develop grit. It’s about finding that one true thing you’re passionate about, and focusing your efforts here. These concepts can be applied to so many different parts of your life beyond your ability to earn income.

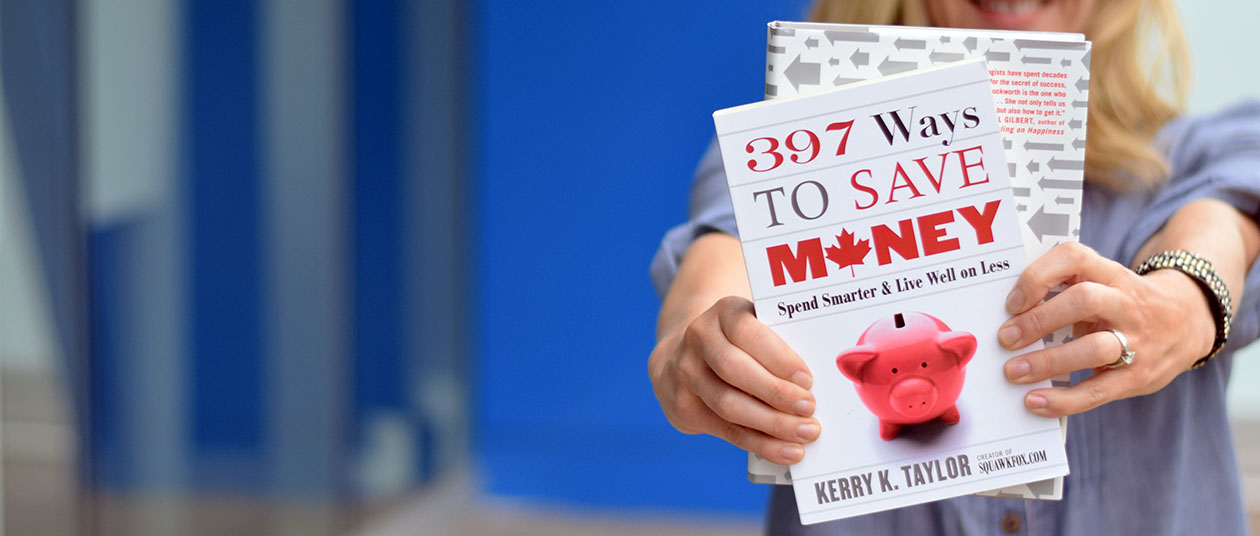

2. 397 Ways to Save Money by Kerry Taylor

What you’ll learn

This book has almost 400 helpful tips on small and large steps you can take to improve your finances. Tips are separated into sections so you can find what really works for you. For example, if you’re a renter, there’s a whole section for you. Homeowner? Taylor’s got you covered, too.

Some examples of what you’ll learn are how you can save by watching your ATM habits, lowering your online shopping costs, reducing your vacation expenses and so on.

Why I love it

This is a really easy read. It’s super practical and has a ton of tips you can apply to every area of your financial life. This is a good one if you’re at the beach or somewhere you might get distracted (in other words, your children need another layer of sunscreen or want another ice cream) as ithis book is easy to get into and come back to again and again.

3. Warren Buffet’s Ground Rules by Jeremy Miller

What you’ll learn

If you’ve done investment research before, odds are you’ve heard of Warren Buffet, who is widely respected for his investment savvy. In this book, you’ll learn some of his key success principles including compound interest, the importance of a long term investment strategy and being aware of fees and their relation to performance. This book is great for readers who have a decent understanding of investments and want to learn more from the investment guru himself.

Why I love it

I’ve always been a fan of Warren Buffet’s investment insights. He’s got a way of making things clear, and leaves the reader with some simple, easy to follow advice:

- He sees the power of compounding interest as an effective long term investment strategy

- Buffet notes the important of working with good investment fund managers areis fully committed to your success

- He reminds us to not get overly emotional with the rises and falls of the marketthe market fluctuates , and the key is to select strong companies and stick with them, despite short-term market swings

There you have it – my top three finance books for you to read this summer. I hope you find them as enjoyable and empowering as I did. And if you ever have any questions about your own finances or how to get the ball moving, just give us a shout. We’re here to help.