The following infographic is available to download as PDF here: Coast Capital How To Forecast Cashflow

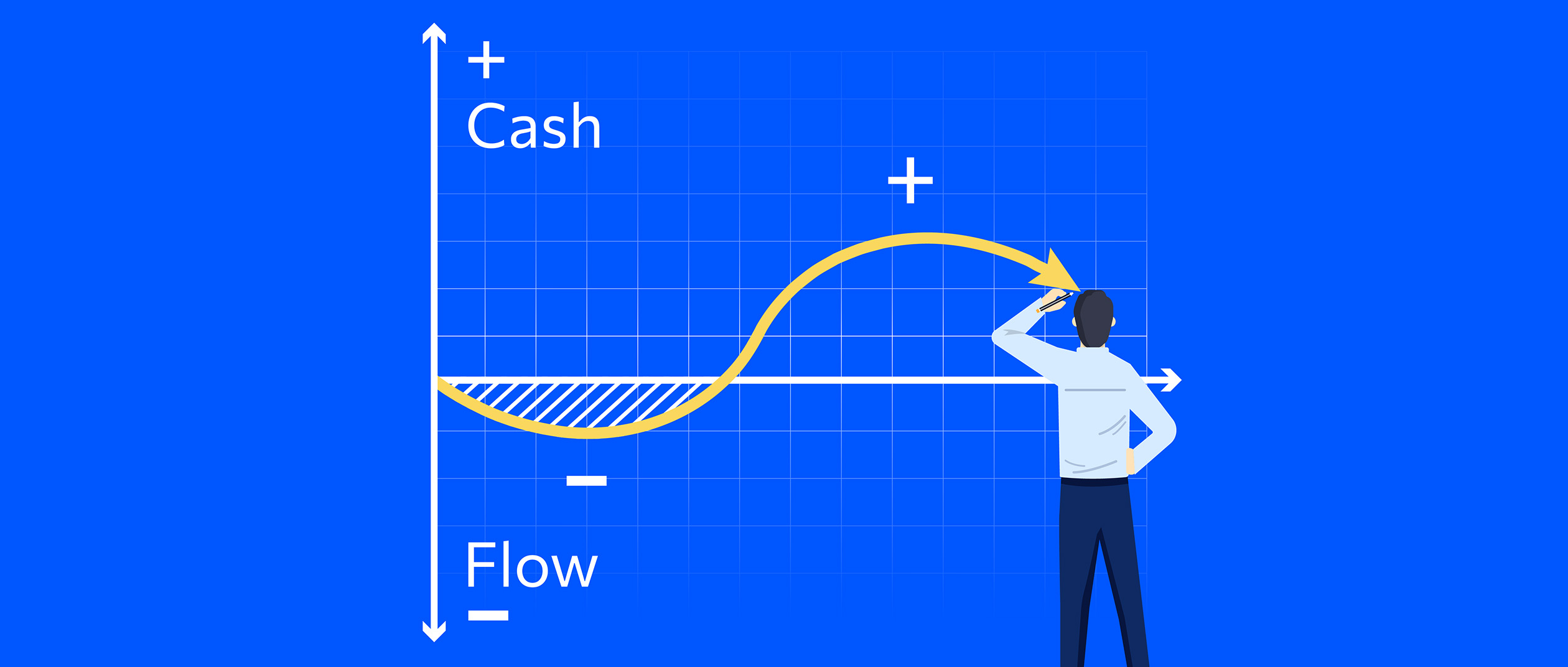

An accurate cashflow forecast is like a map of your business journey. Without it, you run the risk of getting lost before reaching your destination. Predict ahead with the confidence of knowing your cash runway (i.e. the amount of time a business has before it runs out of cash) can cover your overhead with some cash left for growth.

Prepare your business

Audit past behaviour

Review how your cashflow has behaved over the last two or three years. The fluctuations and seasonality of money coming in and out are likely to be industry influenced. Identify these spikes and troughs when forecasting ahead.

Aim for efficiency

Before your begin to charge your engine, find a level of efficiency where you can drive your business as fast as possible while balancing out your operating expenses. Do you really need that extra vehicle? Can your business run smoothly with one less staff member?

33% of small business owners say their biggest challenge is generating enough cashflow to keep going. (Source : Small Business Statistics)

They may be successful, growing and profitable, and yet they can still fail if they don’t have adequate cash to meet the growing needs of their businesses.

Cash or credit?

The flow of money in and out can depend on whether customers pay immediately with cash or credit cards (business to consumer), or if they are invoiced and pay later (business to business). Your credit terms and how you collect payments also influence when money comes in. Even if you’re making a profit, it doesn’t necessarily mean you have cash in the bank. You may have stocked up excess inventory, or purchased fixed assets you don’t always need.

Using accounting software

Accounting software lets you understand your financial situation in real time. Using a cloud-based service will keep your business’s finances up to date every day, as your bank data feeds into the software

Predicting future cashflow

Calculate fixed costs

Work out the total value of your fixed costs (or overhead), such as salaries, power, internet and rent. These costs need to be paid regardless of how much your business generates. If you’re predicting growth, you can experiment with your future cashflow by adding anticipated extra overhead such as new employees, to see how that impacts your bank balance

Identify what’s on the horizon

It’s important to know what’s coming up on the horizon — a gap in planning for future expenses could spell disaster for your business. Insurance and tax payments are a few of the likely expenses you’ll have to pay annually. Determine other future cash influences so you’re prepared

Estimate variable costs: These are costs that vary depending on how much you sell. They might include transport, inventory, materials, contractors, and any fees charged per sale.

Timing of payments : Cash sales will be paid immediately, but sales on credit require payment terms. Map out when future payments will be made so you know when to expect money from credit sales. If you have a history of customers paying late, it’s time to take action and remedy the cause.

Predict your sales levels: Estimate your upcoming monthly sales, using historical figures as a starting point, and taking into account seasonal fluctuations and events where sales can vary

Benefits to your business

- Looking ahead: By completing a cashflow forecast for the coming year, your business is forced to think ahead.

- Managing payments: A cashflow forecast will reveal weaknesses in your debt collection policy. You may be offering payment terms which are too lengthy, or perhaps a regular client is constantly missing their payment deadlines.

- Calculating a break-even point: Predicting sales can be difficult, so it’s helpful to calculate your break-even point. This figure will give you an idea of how much you need to sell to maintain your business.

Just in time (JIT)

Your operation should only have the amount of inventory it needs to continue moving. JIT is a production strategy that aims to reduce inventory — and the operating costs associated with storing it — to improve a business’s return on investment (ROI). Be aware, however, of any supply chain issues which may require you to hold more inventory than before, so you can continue to service your customers.

Periods of excess cash

Your business will be more efficient if it knows when there are likely to be periods of excess cash. Plan how this money will be used or reinvested in advance so your venture can grow.