In mid June, the S&P 500 officially entered “Bear Market” territory, meaning it’s dropped 20% in value from the last market peak. Signs of this drop can be seen in other areas of the stock market. By the end of the trading day on June 17, the S&P 500 was down 22.9% since the start of the year. The NASDAQ has been in bear territory for longer and is down roughly 30.1% since the start of the year. The TSX in Canada is doing somewhat better. It’s down only 10.8%, because of strong performance in the financials, energy and materials sectors. But some parts of the global economy, like crypto currencies, have seen even more dramatic declines.

Driving last week’s dip was the fear that inflation is here to stay and hard to control. In order to slow down inflation, the US Federal Reserve – the central bank of the United States – increased its overnight rate by 75 basis points. This rate hike caught investors off guard. Not only was this increase 25 points greater than most people were expecting, but it was accompanied with the US Federal Reserve’s prediction that it would need to raise rates by another 150-200 basis points this year to keep inflation in its targeted range. The market is reacting to the expected slowdown that often accompanies interest rate hikes.

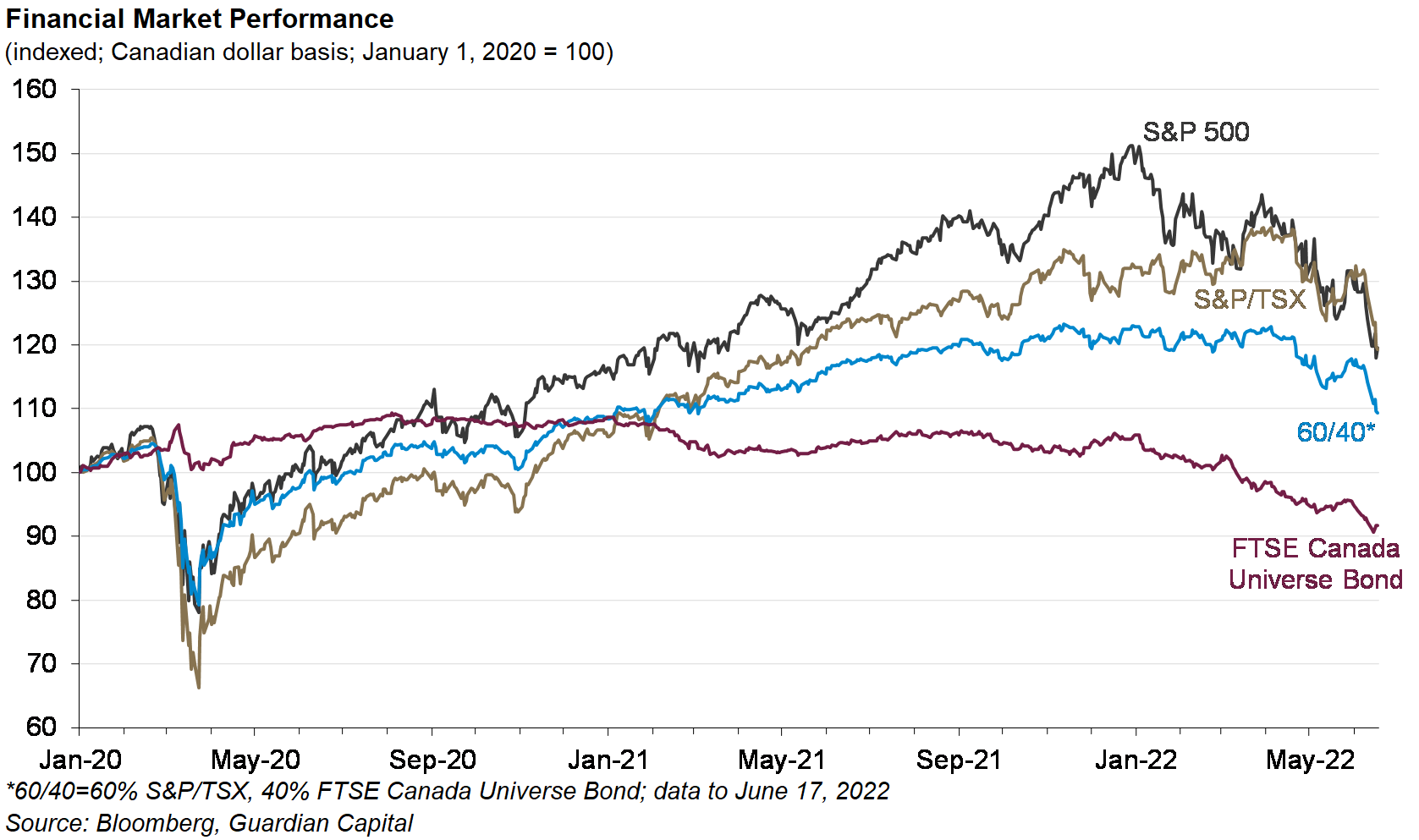

The chart below shows the returns of the Canadian Stock Market (S&P/TSX), the US markets (S&P 500), Canadian Bonds (FTSE Canada Universe Bond) and a balanced portfolio of 60% Canadian stocks and 40% Canadian bonds since the start of 2020. This time frame includes both the steep COVID-fueled decline in early 2020 and the volatility we have seen so far this year. It’s important to note that the three baskets that own stocks have had positive returns, with only the 100% bond portfolio down over that time.

Most of our members who own mutual funds or ETFs will have seen a decline but asset allocation and diversification will have helped soften the decline.

As an investor, what should I do?

Stay invested.

When you started investing, you had certain goals in mind – a new home, for example, or your children’s education. The investments your advisor helped you choose came with a specific risk tolerance and asset mix to help you reach that goal. You knew it wasn’t always going to be an easy ride to your goals, but backing out now will only solidify your losses. Sticking with your investments will help you stay on track with your goals.

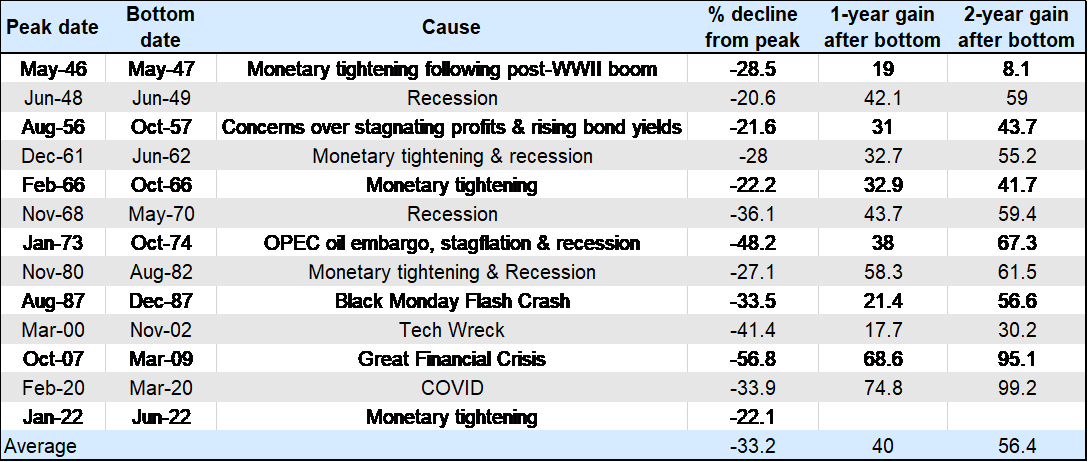

Besides, markets have a history of recovering from significant declines. The chart below shows all of the bear market downturns (over 20% decline) on the S&P 500 over the past 70 years. The average drop was 33.2% from peak to bottom, followed by one year gains of 40% and two year gains of 56.4%. The declines probably felt similar to how we feel today, but history suggests that we will see them recover making a case to stay invested.

Source: Bloomberg, Guardian Capital

Source: Bloomberg, Guardian Capital

Invest regularly.

Perhaps the most common (and commonly ignored) investment insight is to set up regular contributions to your investment account. By doing this, a certain amount is automatically deposited into your investment account with every paycheque. This also helps you buy across all market conditions and ensure you are adding to your portfolio in down markets.

Consider investing more.

For those in a strong financial position, market downturns are an opportunity to buy more at a discount. It’s easier to see this in the rearview mirror but most of us wish we had both the cash and fortitude to invest in down-markets. Consider adding to your portfolio in line with your comfort.

We can help.

Remember: investing is a life-long pursuit. You can expect downturns and times of volatility. Realistic goal-setting, strategic planning, and patience are all important factors that can help guide you through.

Experiencing the pandemic, you probably don’t have to be reminded that times of uncertainty can be emotionally charged. So don’t hesitate to ask for help. Working with a financial advisor can help you avoid rash decisions, understand all of your options, and make plans for the short- and long-term. Connect with one of our advisors today.