The last two years have been unlike anything experienced before in our 80 years of delivering financial advice—but they also followed a familiar pattern. We understand that volatility in the market can be unnerving for some investors, but we’re here to remind members that market instability is to be expected in times of economic uncertainty. And historically, markets have ultimately shown that they will rise over time.

Since the initial drop in March 2020 for example, we’ve seen a considerable amount of volatility but have more or less recovered–something to remember as we monitor the conflict between Russia and Ukraine. The fast-evolving situation and has reintroduced heightened volatility into the global markets as the world reacts to the uncertainty of what may come next, but again we want to remind members that volatility is expected, and markets do recover.

We’re taking a look back at how the markets have behaved since the crash in March 2020 and what we’ve gleaned over the recovery since then that can help us on a clearer road ahead.

(For more information on the economic effects of the Russian-Ukrainian conflict, read Another Brick in the Wall of Worry by our partners at Guardian Capital.)

Taking care of business

While there were ebbs and flows as the result of the waves of COVID-19 infection and resultant reintroduction of stringent public health measures, the general underlying strength in the global economy amid the continued recovery from the worst of the pandemic’s impact on activity, underpinned by the unprecedented degree of support from global governments and central banks, supported robust growth throughout 2021.

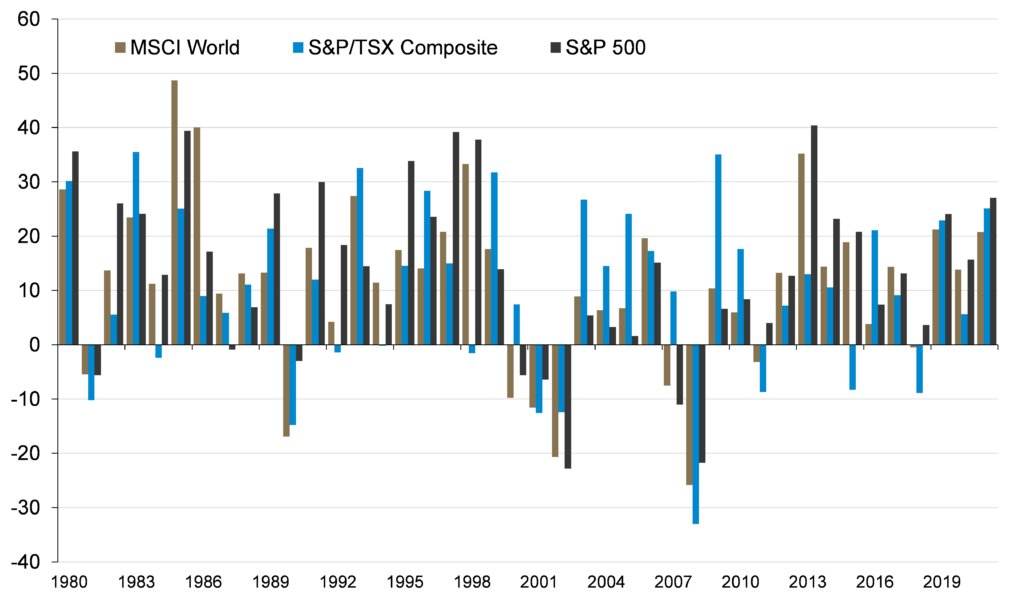

Against a high growth and low interest rate environment, corporate profits rebounded sharply from their earlier pandemic-induced weakness, not only making good on the promise implied by 2020’s post-crisis rally but also providing a fundamental support for continued gains equities through the year — the MSCI World Index generated a 20.8% total return for the year as a whole, Canada’s benchmark S&P/TSX Composite Index’s 25.1% total return marked its best performance since 2009 and the American S&P 500 generated an eight-year high 27.1% gain.

Under pressure

The surprising resiliency in demand from both consumers and businesses against ongoing pandemic-related supply constraints, however, factored into a broad increase in price pressures that have proven to be far more persistent than initially assumed.

Combined with heartening indications of improving underlying growth momentum, pressure has increased on policymakers worldwide to begin to unwind their crisis-era stimulus to help temper demand and contain price pressures.

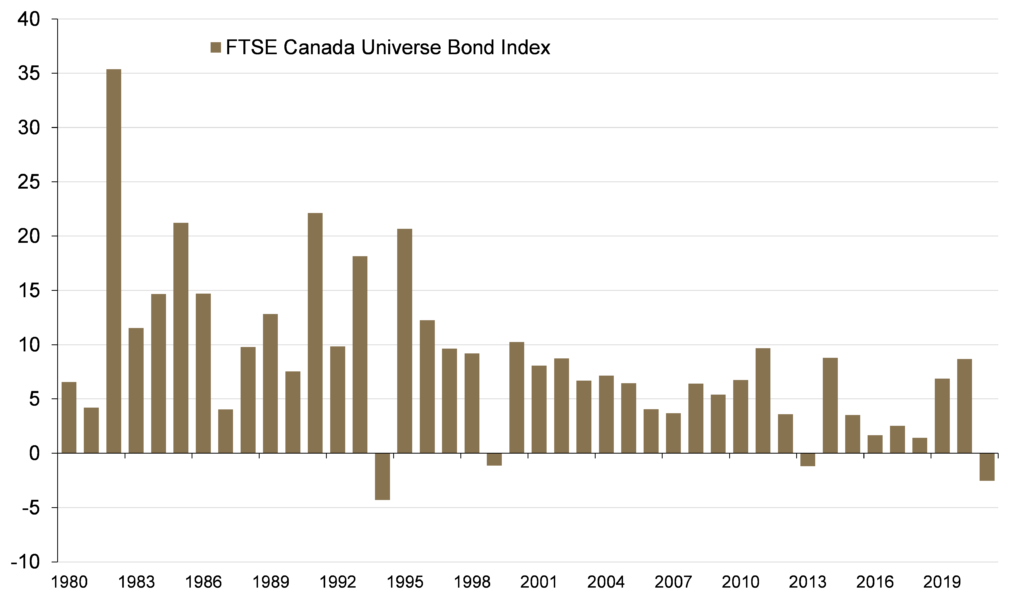

The result was that market interest rates moved higher from historic lows established in 2020, creating a headwind for performance in fixed income markets (where prices move inversely with yields) — the FTSE Canada Universe Bond Index declined 2.5% in its worst year since 1994.

Change is gonna come

As the calendar has rolled over, the risks that dominated the past year remain, but the balance has shifted.

On the positive side, while the pandemic continues, there are growing hopes that the current (now ebbing) wave of infection could mark the turning point toward the end — while COVID-19 is unlikely to disappear, the increased resistance to infection across populations brought about by prior illness and vaccination could limit the severity of future outbreaks (not to mention the significant progress at managing and treating illness with effective therapeutics) to the extent that they no longer constitute an “emergency”.

More negatively, inflationary pressures have intensified, raising the risk that rapidly rising prices could erode demand and placing added impetus on central banks to act swiftly and aggressively — market expectations for policy tightening have increased sharply, pushing market interest rates sharply higher.

The strength in consumer finances, potential upswing in business investment and the boost associated with a broader/full reopening of activity (especially in services) should mean that the economy has the capacity to absorb higher interest rates, however, central banks have historically struggled to calibrate monetary policy in such a way that financial conditions do not tighten too much, too quickly — and ultimately, efforts to find a remedy for inflationary pressures end up being worse for growth than the disease itself.

Lean on me

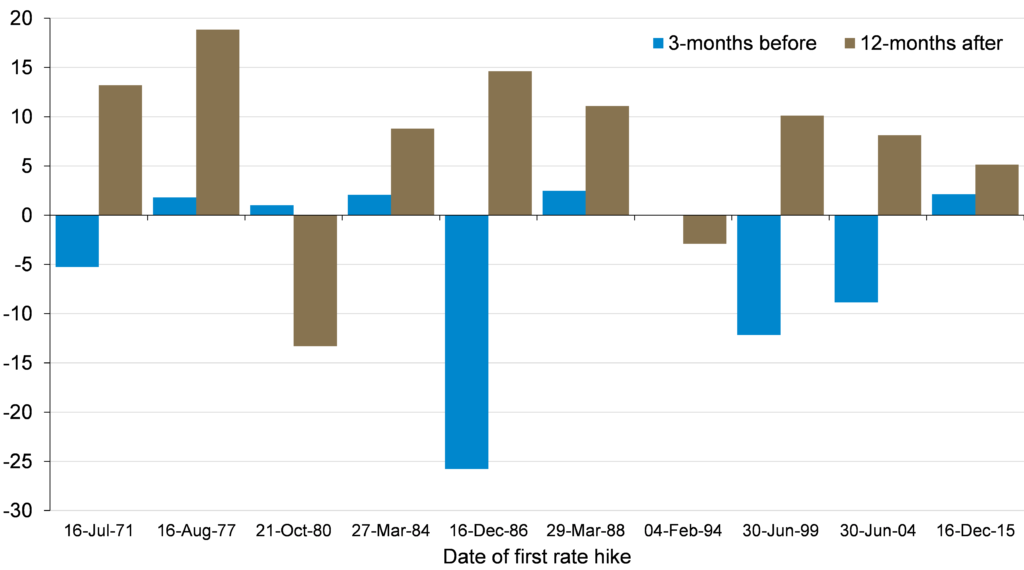

The prospect of a tightening cycle is understandably being met with trepidation over the future. From a here and now, perspective, however, it would stand to reason that if there is a need to slow the economy, things are actually going quite well which would instead seem to suggest that the base case for stocks is at worst neutral and probably bullish.

Indeed, while the lead up to policy change has historically been negative for markets — the MSCI World Index has declined by an average and median of 4% in the three-months leading up to the first forays into policy tightening — once the ball is rolling and there is more clarity on the road ahead, markets tend to perform well — the MSCI World Index has been up one year after the first hike in 8 of 10 occasions and by an average (and median) of 7%.

With that said, however, the volatility that has come to characterize the early weeks of 2022 is unlikely to subside in a material fashion in the weeks to come, in fact we have seen additional movements linked to the Ukraine situation.

As such, it is important for members to check in with their advisors to review investment objectives and risk tolerances to ensure that you are comfortable with the risk exposures inherent in your portfolios — this is especially the case after a year like last year where the big divergence in performance between stocks and bonds can result in significant drift in a portfolio’s asset mix.

Having a well-established financial plan developed with your Coast advisor focused on your individual circumstances and longer-term goals can help to rein in impulses during bouts of market volatility — history has shown time and time again that allowing emotion to drive the investment decision making process is bad for investors’ wealth, as short-sighted and undisciplined reactions to short-term events can carry significant negative implications for long-term portfolio performance.

No matter what your current situation looks like, our advisors are here to help you weather the storm and come out the other side in the strongest financial situation possible. Our commitment is to meet you where you are in this moment and provide trusted advice that you can rely on at every stage of life.

If you have questions about your plan, we recommend reaching out to your advisor to make sure you’re still on track to reach your goals.