The first four and a half months of 2022 have been challenging from an investment perspective. Some of the sectors that led the charge through the pandemic, and particularly in the stellar returns of 2021, have seen their share prices drop significantly. At the same time, we’ve seen rising interest rates over both the short and long term that has negatively impacted bond returns, and we’ve seen declines in the value of broadly-held bond funds and the income portion of balanced funds.

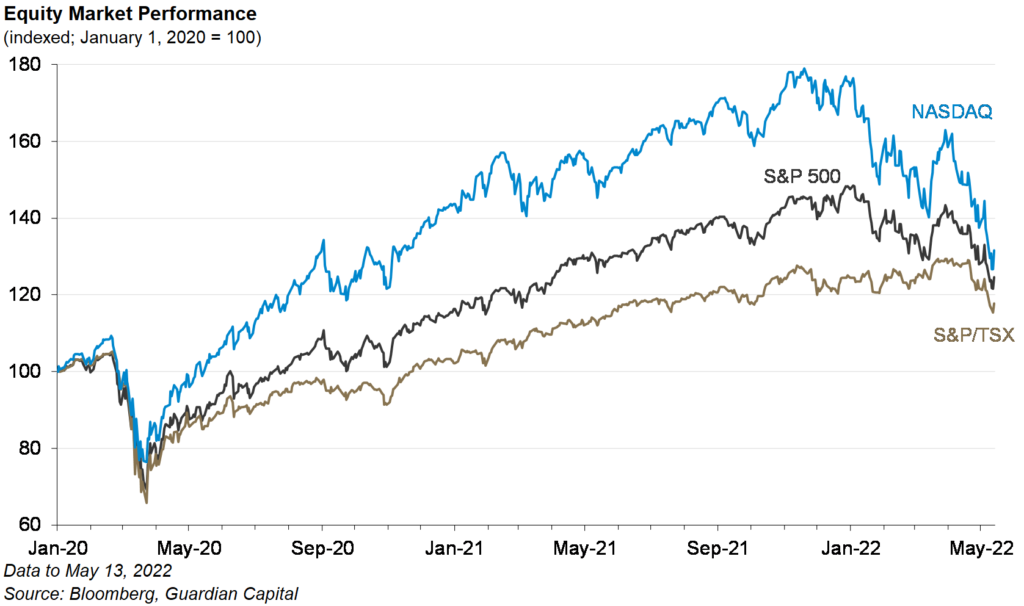

At the time of writing, we’ve not officially entered a bear market but it sure feels like it. It probably makes sense to put some things in perspective and take a look back over the last two and a half years to see how you as an investor may have fared. Over that time, COVID-19 caused one of the largest economic contractions the world has ever seen, followed by unprecedented government stimulus, and we saw a very sharp drop and then a fast recovery in global stock markets that led to strong returns over last half of 2020 and all of 2021. Even with the start of the 2022 being negative, investors in the indexes below are well ahead of where they were before the Covid outbreak. The S&P 500 is up a total of 24.6% ( 9.37% annualized ), the S&P TSX is up a total of 17.8% ( 6.91% annualized ) and the Nasdaq is up a total of 31.6% ( 11.84% annualized ). ( Source Bloomberg, Guardian Capital)

What are the key concerns that are causing turmoil in the markets right now?

- Inflation: we’ve seen global inflation numbers increase dramatically, and in North America we’ve seen them increase from modest, low single-digits to 6.8% in Canada ( Source: Statistics Canada) and just over 8.3 in The United States. (Source US Department of Labor) This is important as central banks and governments are pivoting from providing stimulus and low interest rates that were required to help the economy through COVID, to combating inflation. The best tool central banks have in this battle is increasing interest rates and a government’s best tool is reduced spending. Both of these have impact on the stock market. Items that are driving inflation at the moment include elevated energy, food, and automobile prices. It is expected that inflation will moderate, but many questions remain about timing and where it will settle to.

- Interest rates: rates have risen and are expected to continue rising over the next 18-24 months. Rising interest rates have an impact on the cost to borrow and immediately make variable rate loans and mortgages more expensive. Those with fixed rate loans and mortgages are protected until renewal date. Homeowners with mortgages may find their borrowing costs significantly higher—there may be similar impacts for governments and corporations as well.

- Conflict in Ukraine: The Russian invasion of Ukraine has increased perception of risk, particularly in sectors where Russia and Ukraine have significant global impact, particularly energy and grain production. The outlook for this conflict is uncertain and does not look to be close to resolution. The global sanction response has had a major impact on the Russian economy, but also comes at a cost to the countries imposing them. As Europe looks to lessen its dependency or completely ween off of Russian oil and gas, there will be significant cost impacts to manufacturers and residents.

- While the decline has been led by technology stocks, it has been pretty broad. Some key companies who benefited dramatically from COVID have seen their post-COVID world look not so rosy, such as Netflix and Shopify. We’ve seen the NASDAQ (technology-heavy index) down much more so than the broad S&P500. It’s important to remember that both the NASDAQ and the S&P500 had outsized returns in 2021 and the NASDAQ was up [40%] over the period of 2020-2021 as seen in the charts above.

- Countering these concerns: There is a number of positive economic indicators including low unemployment and a large number of job openings that suggests that there is strength in the North American economy, so we may not experience a prolonged or severe economic contraction

As an investor, what should I do?

Stay Invested

Time in the market is one of the best ways to help returns, you started investing with certain goals in mind, and with a specific risk tolerance and asset mix, so stick with your approach with your investments.

Regular Investing

Perhaps the most common (and commonly ignored) investment insight is to set up regular contributions to your investment account. By doing this, a certain amount is automatically deposited into your investment account with every paycheque. This also helps you buy across all market condition and ensure you are adding to your portfolio in down markets.

Consider Investing More

For those in a strong financial position, market downturns are an opportunity to buy more at a discount. It’s easier to see this in the rearview mirror but most of us wish we had both the cash and fortitude to invest in down-markets. Consider adding to your portfolio in line with your comfort.

We can help.

Remember that investing is a life-long pursuit, and you can expect downturns and times of volatility. Realistic goal-setting, strategic planning, and patience are all important factors that can help guide you through.

Experiencing the pandemic, you probably don’t have to be reminded that times of uncertainty can be emotionally charged. So don’t hesitate to ask for help. Working with a financial advisor can help you avoid rash decisions, understand all of your options, and make plans for the short- and long-term. Connect with one of our advisors today.