The last three years have been incredibly, and persistently, tumultuous, with the constant ebbs and flows of developments — surrounding things including the pandemic, geopolitics, inflation and interest rates — serving to underline the importance of having access to a trusted financial advisor to support you in achieving your long-term goals.

In partnership with Guardian Capital, and as part of our commitment to delivering advice that is insightful, relevant, and most importantly, in your best interest, we thought it would be worth taking a look at where things stand and what can be expected for the year to come.

The best laid plans…

A year ago, the outlook was pretty positive. The anticipated move back to “normal”/pre-pandemic levels of activity would underpin sustained economic growth rates above the past decade’s trends. While inflation was on the rise, it was still being viewed as “transitory”, a by-product of the onset of the pandemic that would be unwound as the broader reopening of the global economy continued.

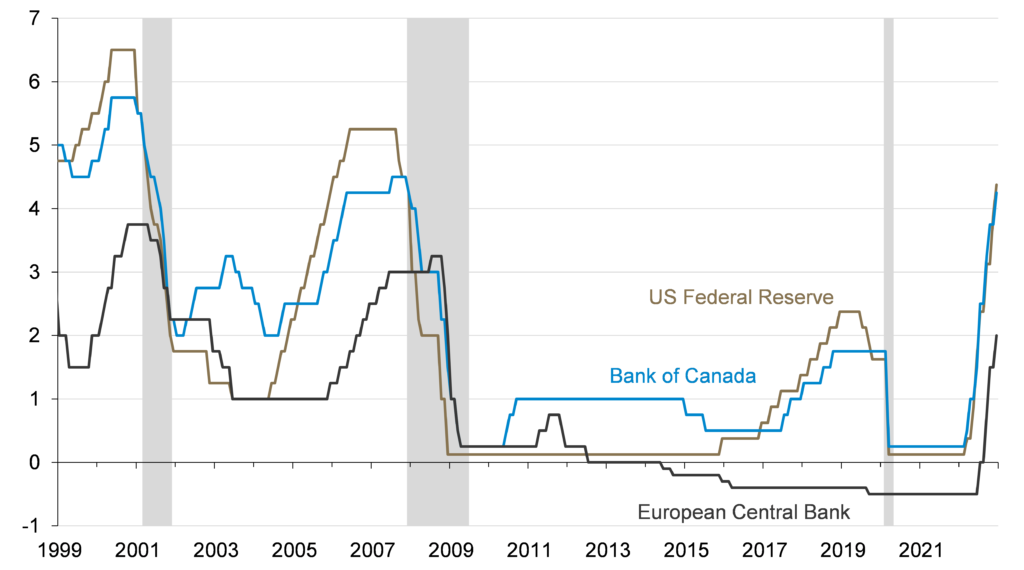

Central banks, while acknowledging that crisis-era levels of policy stimulus were no longer warranted, were in no hurry to raise rates, and would move only gradually once they did. As a result, interest rates remained near historical lows, and the persistently low costs of borrowing provided support for the global economic cycle as it transitioned from “recovery” mode into “expansion” mode.

Central banks believed keeping interest rates low would help companies drive robust growth as we reentered the global economy. This anticipated growth was expected to translate into similar growth in the stock markets; despite most publicly traded company values trading at near all-time highs, a situation that traditionally moderates equity growth. While some may have questioned the intent of increasing the valuations of stocks, persistently low interest rates meant that investors lacked reasonable alternatives to generate investment returns. Accordingly, investors were upbeat and willing to continue chasing momentum.

…often go awry.

Of course, inflation quickly proved to be anything but transitory. The imbalance between strong demand and constrained supply was exacerbated by the persistence of supply chain pressures due to renewed public health restrictions early in the year (particularly those in China) and the shock to commodity prices brought about by Russia’s invasion of Ukraine. in response to shifting inflation expectations, monetary policymakers felt pressure to move quickly and aggressively to try to get ahead of increasing inflation. Central bankers feared failing to get ahead of inflation early on would lengthen the time of higher prices and have long term impacts on the economy.

Suddenly, financial markets, that had largely been permitted to ignore inflation and interest rates over the last decade, were forced to recalibrate — first slowly, then all at once as the breadth and magnitude of central banks’ responses to rising inflation sunk in.

An abrupt shift.

(central bank policy interest rate; percent)

Collateral damage.

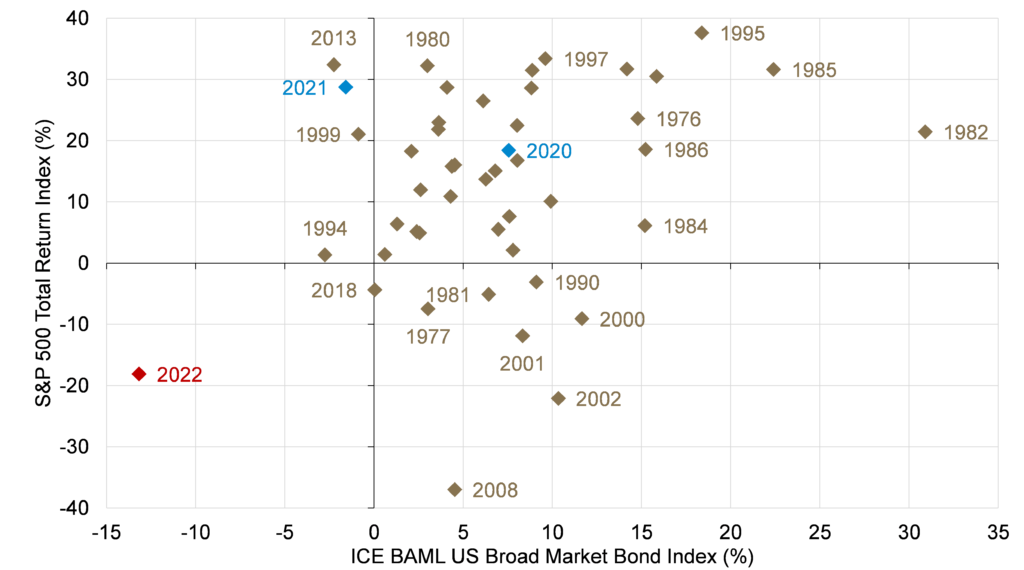

The sharp upward adjustment in rates hit fixed income securities the worst. The previous decade of low rates meant that bonds issued even 2 years ago were now worth significantly less than the price investors had paid when they purchased the security as newer issue bonds reflected the now higher interest rate returns

Equities were on the receiving end of a series of body blows as well. Just as low rates boost valuations, higher rates compressed valuations, particularly among the high-flying growth stocks. The combination of geopolitical shocks, increasing interest rates and central bank warnings of a global economic downturns was reflected in company earnings (profitability) forecasts. The combination of these factors and increased economic uncertainty further eroded company valuations in the eyes of investors leading investors to increasingly shy away from investing in equities.

The end result was a historical outlier of a year — while equities have posted bigger calendar year declines in prices, bonds have not. This is the first time in the last four decades where both have declined at the same time (let alone by similar magnitudes) meaning that there was no cover for balanced investors.

An outlier of a year.

(asset class calendar year total return; percent, US dollar basis)

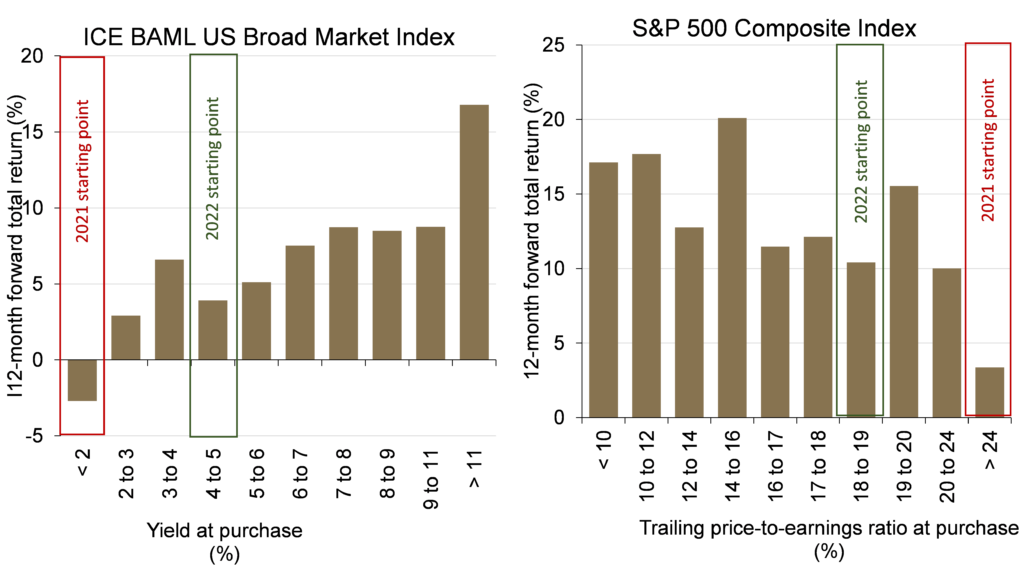

Lowering the bar.

As the focus shifts to the year ahead, what stands out is that the backdrop is almost the polar opposite of what prevailed 12 months ago.

The current consensus is that a recession is effectively a certainty in the next 12 months as the now restrictive monetary policy stance by central banks restrains demand and accumulated savings buffers get drawn down.

This anticipated moderation in demand growthcombined with easing supply chain constraints suggests that inflation could continue its nascent moderating trend — but demand is expected to remain elevated relative to pre-pandemic rates which will likely keep central banks from unwinding their policy tightening in any sort of earnest manner.

From a market perspective, this backdrop and 2022’s negative return across asset classes means that last year’s optimism and expensive assets have been replaced by pervasive pessimism and more moderate asset values. Somewhat ironically, this perspective makes for a more constructive outlook for performance, from both stocks and bonds, than prevailed a year ago. Nothing is guaranteed in investing; however, history shows returns tend to be materially better when valuations are off their extremes and at more normal levels.

A value proposition.

(average 12-month forward return by valuation at purchase; percent, US dollar basis)

That said, the persistence of risks and uncertainty surrounding the outlook for this year suggests that heightened volatility is likely to remain for the foreseeable future. Any improvement over the last 12 months’ dismal performance is unlikely to come in a straight line and there is a real possibility of future declines. Despite the spillover of lowered expectations from 2022, the balance of risks is currently skewed more towards the upside.

It remains prudent for investors to be disciplined towards volatility and resist the urge to sell into a down market. Maintaining a long term focus when making investment decisions and choosing to selectively add to high quality investments will help investors achieve their goals sooner than taking riskier positions in the hopes of quickly unwinding last year’s declines.

A well-established financial plan developed with your Coast advisor based on your individual circumstances and objectives can serve as your anchor amid these volatile times. Staying on plan helps to ensure that short-term disruptions do not get in the way of your longer-term financial goals.

No matter what your current situation looks like, our advisors are here to help you weather the storm and come out the other side in the strongest financial situation possible. Our commitment is to meet you where you are in this moment and provide trusted advice that you can rely on at every stage of life.

If you have questions about your plan, we recommend reaching out to your advisor to make sure you’re still on track to reach your goals.

![]()

![]()