Saving for the future can often be difficult and time-consuming, whether you’re reviewing your budget or researching ways to stretch your spending further. Wouldn’t it be nice if there was a way you could feel confident in your financial future, while putting money aside – without all the extra work?

There is a way, and it’s called a pre-authorized contribution (or PAC). When you sign up for PACs, a specific, predetermined amount of money is automatically transferred from your chequing account and deposited into a savings or investing account on a regular, recurring basis. You decide how often this occurs – weekly, biweekly, semi-monthly, or monthly.

Still not sure if PACs are right for you? Here are three major reasons why you should sign up for pre-authorized contributions now.

1. You benefit from paying yourself first.

The hardest part of saving for the future is finding the money to put aside for yourself after you’ve paid all your bills and made all your important purchases. “Paying yourself first” helps you overcome this problem with a solution that is easy to understand and even easier to implement. Most people achieve this with the help of a PAC they schedule to run the day they’re paid, so that they can transfer money into a savings or investing account before they have time to spend it. That way, when it comes time to pay their bills, they feel more confident knowing they’ve already taken care of their long-term financial needs. Plus, if any money is left over afterwards, it can be used either as additional savings or a guilt-free discretionary purchase, like clothes or a new TV.

2. You reach your goals sooner with compound interest.

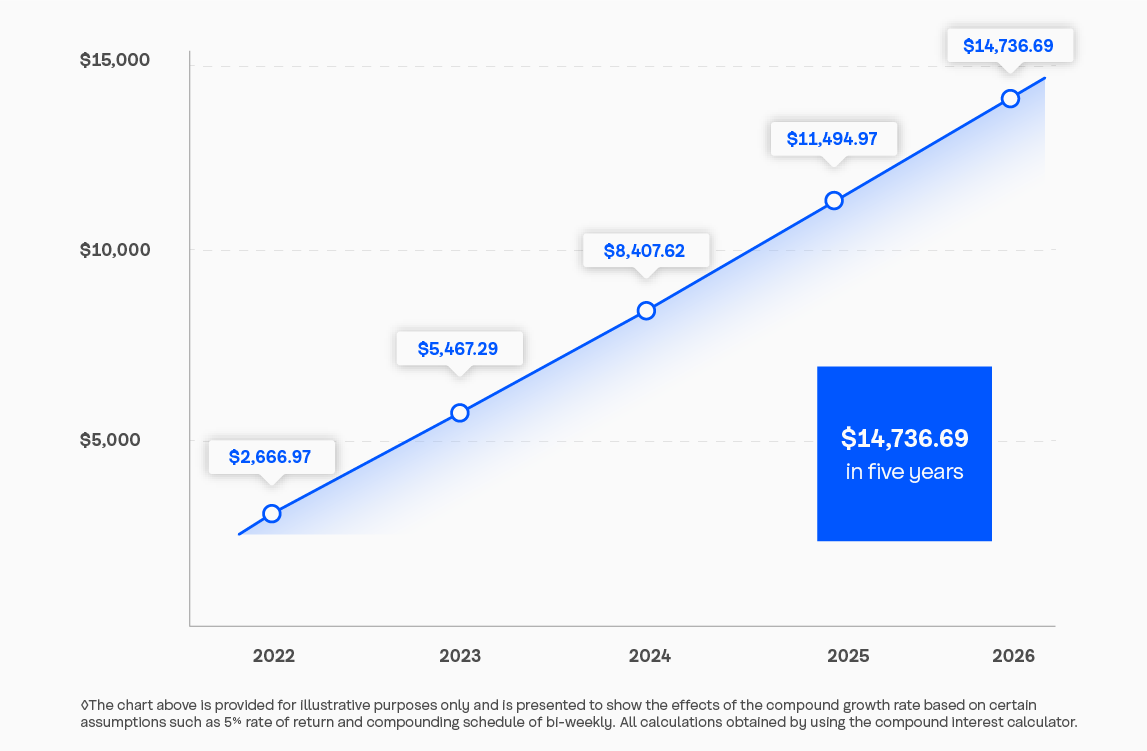

When you invest money with PACs, you’re paying yourself first and being rewarded for your good financial habits with compounding returns, the term used to describe the returns you earn on the initial investment plus previously earned returns. Though it sounds complicated, the way it works is simple. If you invest $100 every two weeks into a balanced investment, assuming a consistent 5% return, your investment could grow to over $14,000 in just 5 years.◇ It’s not hard to see why Albert Einstein – yes, that Albert Einstein – once famously quipped that compound interest is the eighth wonder of the world.

3. You save on investing with dollar-cost averaging.

In addition to earning more with compound interest or returns, you save money on investing with dollar-cost averaging, which may bring down the overall cost of investing over the long term. Here’s how it works. Under normal circumstances, you might want to wait and see the price of a mutual fund, ETF, or other form of investment before purchasing. If the price is high, you might not buy until it drops again. But this can be difficult time and often leads to potential investors missing great opportunities. With dollar cost averaging, however, you automatically purchase an investment of your choice, such as a mutual fund, with the same amount of money on a regular, recurring basis. If the price is high, the amount you’re automatically spend will buy fewer units. But when the price drops, you’ll buy more. These PACs may help you bring the average cost down and build your savings at the same time.

We’re here to help.

When you’re a Coast Capital member, we’re with you every step of the way because your success is our success. We deeply value real human connection and that’s why, for over 80 years, we’ve been a trusted partner for our members. The more we understand you personally, the better we can help you create the real life you want today.

Find out how you pre-authorized contributions can help you reach your goals sooner when you visit a Coast Capital branch or call us at 1.888.517.7000.