Mortgage myth busters to boost your financial IQ

Congratulations. You’re finally able to afford that mortgage for the house of your dreams, and you’re ready to start your search for the perfect home and the right mortgage to…

How porting your mortgage can save you money

Are you in your forever home? Do you plan to move sometime soon? Regardless of which life stage you’re in, as a homeowner, the option to port or move your…

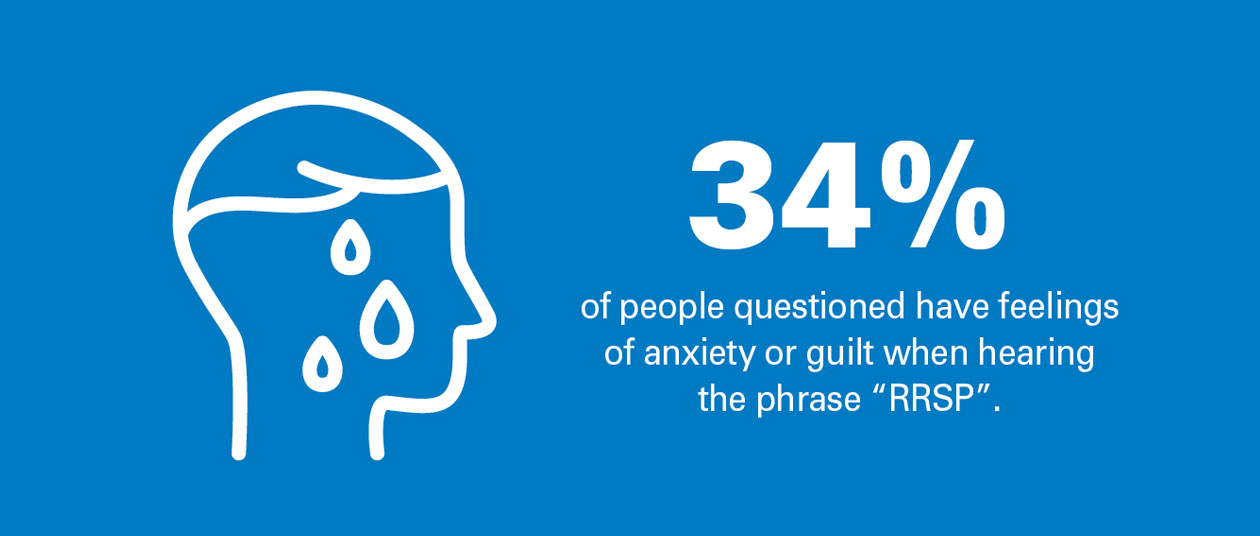

Feeling stressed about RRSPs? You’re not alone.

As March 2 approaches (that’s the RRSP contribution deadline for the 2025 tax year), many British Columbians experience feelings of guilt and anxiety just thinking about retirement savings. We recently…

Financing vs cash: which is better when buying a car?

There are two main ways of buying a new car: in cash (paying the total cost in full with your savings), or with auto financing. Although it might seem like…

When should you consider refinancing your mortgage?

A mortgage is a long-term financial commitment, but there is always some wiggle room if your circumstances change and you want a new deal to match. You usually have some…

What to do if you’ve lost your job to COVID-19

One of the many unfortunate realities of the COVID-19 pandemic is the financial stress millions of people around the globe began facing, nearly overnight. Businesses are closing, and workers are…

What can your small business do to cope with COVID-19

As of March 2020, businesses across Canada were forced to shift their operations and business models overnight to ensure the safety of employees and their customers alike in the face…

A financial small business guide to getting through COVID-19

The COVID-19 crisis is causing business disruption that is extraordinary in scope. It’s safe to say that no small business operators have faced challenges as swift or unpredictable as the…

How to budget your CERB

Millions of Canadians have applied to receive the Federal Government’s CERB, and many are starting to see the cheques appear in their accounts. In unprecedented times such as these, it’s…