It can be confusing, as a business owner, trying to balance having access to cash with growing your returns – but we’re here to make it simple. Learn more about the best way to allocate your funds and make smart money moves for your business.

Chequing Accounts vs Savings Accounts.

Your chequing account helps you send and receive payments. More than any other, your chequing account is ideal for handling the kinds of high-frequency transactions that come with sales and expenditures. That’s why it’s so important to make sure you’re keeping enough cash in your chequing account. Anything less might mean missing payments, falling behind on loans, or worse. You can avoid these difficulties by keeping a “float” in your chequing account, a minimum amount of cash that covers all your ongoing expenses, plus whatever you decide is appropriate to cover unexpected costs.

Your savings account is just as important and can help you build towards longer-term goals. With the help of compound interest, you can grow the money you put aside in your savings account – essentially rewarding yourself for practicing good financial habits. But what you gain in long-term growth, you lose in day-to-day usability. Though you have access to your funds at any time, there are usually only a set number of payments you can make from your savings account before you take on transaction fees. Getting the most value from your savings account means planning for when and how you want your money to be spent.

By far the best way to get value from your chequing and savings accounts is to use them together. For example, redirect a certain percentage of your earnings to your savings account, keeping the rest in chequing. Doing this on a regular basis will help you build savings that you can use for emergency funds and future purchases, while also helping you maintain a float in your chequing account for ongoing cash needs. With one main chequing account handling your day-to-day operations, you can open multiple savings accounts, each for their own goals. Some can be used for equipment, others for investing, and so on. By using the chequing and savings accounts together, new strategies will emerge that make sense for you.

Make your savings work harder.

For idle cash not being used as a float, consider keeping it in savings accounts or investments offering returns. Interest earned in savings and investments can help protect your savings from inflation while making sure you continue growing towards your goals. But it’s not always obvious how you can save money effectively. Different accounts can help you achieve different goals. Some are more appropriate than others, depending on what you want to accomplish.

The best way to understand which savings option is best for you is to gauge whether your goals are short, medium, or long-term. Short-term goals are less than 1 year away, medium-term goals are between 1-5 years away, and long-term goals can be up to 10 years away. Savings accounts are best for goals up to 12 months out. Business demand savings accounts give you the most liquidity while providing interest income. High Interest Business Savings Accounts (HIBSAs) offer better returns with the option to earn more, the more you invest. The interest rate you receive on these funds will help you earn a little extra, but probably won’t be enough to help you reach larger goals. The real advantage offered by savings accounts is the simple access to funds, which is important for emergencies. For medium and long-term goals, few savings options are as effective as GICs, many of which offer higher interest rates in exchange for lock-up periods that ensure you’re committed to investing. Their guaranteed returns keep your funds safe, while the higher interest rates may help keep you ahead of inflation. Long-term goals require more investment. A number of options are available for achieving the growth that will get your closer to your aims. Speak with your Investment Advisor to find out which options are best for you.

Balancing flexibility with returns.

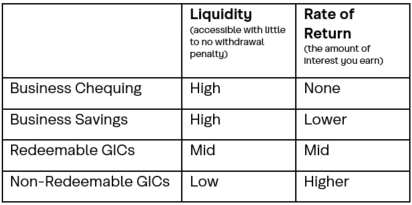

It’s generally the case that accounts and investments offering better returns have less flexibility, while accounts and investments that offer better flexibility present lower returns. The tradeoff is important to understand, and finding the right one for you can be difficult. The following chart is designed to help you find the balance that makes the most sense for your needs.

Crunching the numbers.

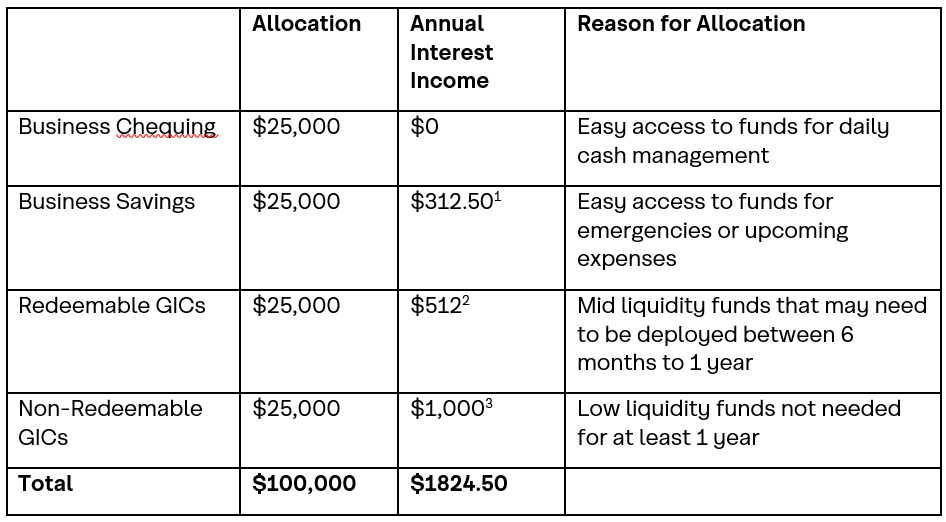

Given the varying degrees of flexibility with returns across accounts and investments, the following chart will show you what kinds of returns you can expect based on where you put your money. Here’s a breakdown of how a business with $100,000 could allocate their money according to spend cycles and savings goals, and the corresponding amount of interest they could earn within their chequing, savings, or GICs:

1 Based on CCS HIBSA as of September 13, 2022

2 Based on CCS 1 year redeemable GIC rate as of September 13, 2022

3 Based on CCCS 1 year non-redeemable GIC rate as of September 13, 2022

Speak with an advisor today.

Figuring out how to allocate your money can maximize your interest while also allowing flexibility to fund your business—even if something comes up unexpectedly. If you need a second set of eyes on your books, and advice on how to best balance your liquidity with your returns, we can help. Speak with one of our small business experts when you visit a Coast Capital branch or call us at 1.888.517.7000.